2014–15 Annual Report HTML

Annual Report 2014–15 Commonwealth Director of Public Prosecutions

CONTENTS

- Highlights

- Letter of Transmittal

- Summary of 2014–15 Performance

- Director’s Review

- Chapter 1 About Us

- Chapter 2 Our National Practice Areas

- Chapter 3 Our National Practice Groups

- Chapter 4 Our Partnerships

- Chapter 5 Our Performance

- Chapter 6 Our Corporate Governance

- Chapter 7 Our People

- Chapter 8 Finances

- Chapter 9 Financial Statements

- Chapter 10 Appendices and References

- Chapter 11 Index

- Our Offices

- Contact Details

List of tables

- Table 1: National Practice Groups and crimes we prosecute

- Table 2: POC Act 2002—orders and forfeitures in 2014–15

- Table 3: Criminal Assets: summary of recoveries for 2014–15

- Table 4: Legislation under which charges were dealt with in 2014–15

- Table 5: Referring agencies: defendants dealt with in 2014–15

- Table 6: Outcomes of successful prosecutions in 2014–15

- Table 7: Summary of prosecutions in 2014–15

- Table 8: Committals in 2014–15

- Table 9: Prosecutions on indictment in 2014–15

- Table 10: Prosecution appeals against sentence in 2014–15

- Table 11: Defence appeals in 2014–15

- Table 12: Reparation orders and fines

- Table 13: Prosecution performance indicators for 2014–15 (national totals)

- Table 14: Prosecution performance indicators for 2013–14 and 2014–15 (national totals)

- Table 15: Audit Committee membership

- Table 16: Audit Committee attendance 2014–15

- Table 17: Audit Committee members

- Table 18: Staffing headcount by classification level and region at 30 June 2015

- Table 19: Workforce profile by classification

- Table 20: Workforce profile by location

- Table 21: Average staffing level by location 2014–15

- Table 22: Staffing summary

- Table 23: Workforce profile by category summary

- Table 24: Workforce diversity profile by classification at 30 June 2015

- Table 25: Workplace diversity summary

- Table 26: Salary scales at 30 June 2015

- Table 27: Legal services expenditure

- Table 28: Environmental performance during 2014–15

- Table 29: Agency resource statement

- Table 30: Expenses by outcome

- Table 31: List of requirements

List of figures

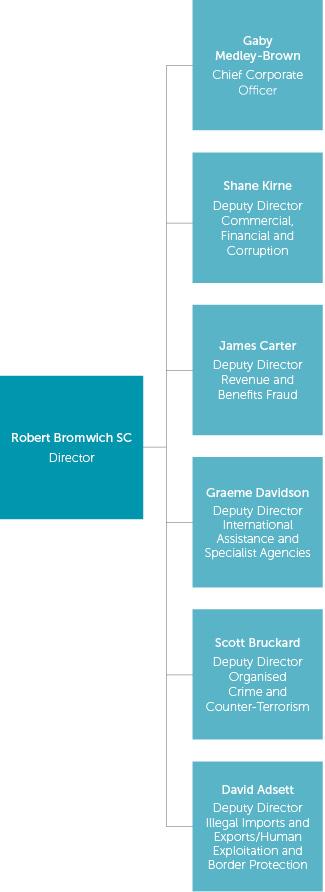

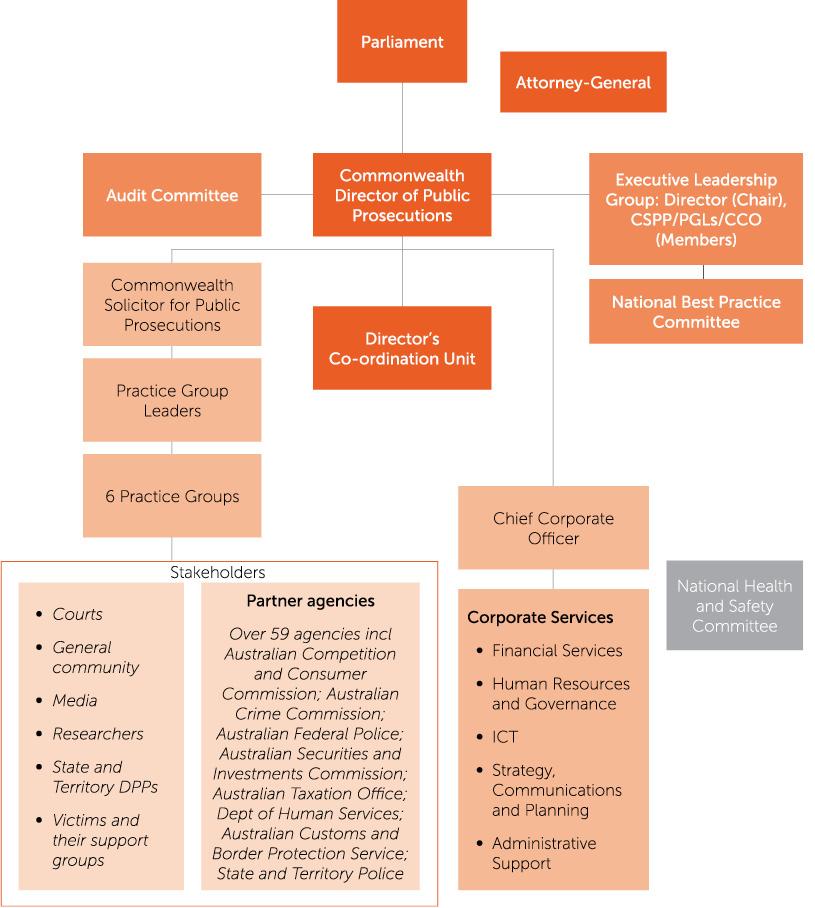

- Figure 1: Organisation chart at 30 June 2015

- Figure 2: CDPP governance structure at 30 June 2015

COMMONWEALTH DIRECTOR OF PUBLIC PROSECUTIONS

Australia’s Federal Prosecution Service

Contributing to a fair and just Australia

OUR AIM

We will provide an effective and efficient independent prosecution service that contributes to a fair, safe and just Australia where Commonwealth laws are respected, offenders are brought to justice and potential offenders are deterred.

OUR LEGAL PRACTICE

We will:

- be fair, consistent and professional in everything we do

- work with our partner agencies to assist them in advancing their goals and priorities in accordance with the Prosecution Policy of the Commonwealth

- treat victims of crime with courtesy, dignity and respect.

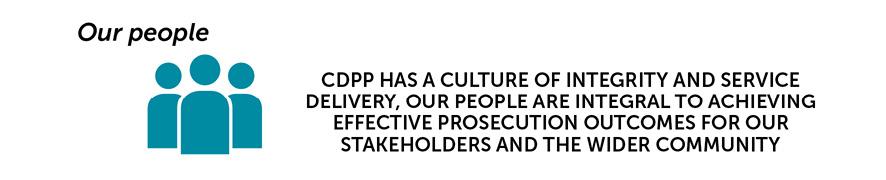

OUR PEOPLE

We will recognise, value and develop the knowledge and skills of our people.

By investing in effective people development programmes to support continuous learning we will enhance our workplace culture—build resilience, reward effective performance and implement a performance measurement framework.

ADVISE

We work collaboratively with stakeholders.

Partner agencies rely on the CDPP to bring their investigations to conclusion through prosecution.

The CDPP provides guidance through pre-brief advice.

PROSECUTE

We prosecute crimes against Commonwealth law.

By taking legal action against offenders the CDPP helps protect the broader community.

Successful prosecutions convict offenders and break down criminal networks−delivering justice through effective sentencing.

EDUCATE

Educating the community about our prosecution outcomes helps build public confidence in the CDPP as a vital part of the Australian justice system.

Through education we aim to deter potential offenders by highlighting the serious consequences for individuals convicted of crimes committed against the Commonwealth−our work sends a strong message that serious crime will not be tolerated.

OUR PROSECUTION OUTCOMES— 2014–15 AT A GLANCE

We work closely with partner agencies to bring cases to a close through effective prosecution.

- 4,909 matters before the courts

- An average of 409 matters per month or 94 matters per week

Resulting in:

- 2,156 prosecutions resulting in a conviction

- 1,011 defendants sentenced to imprisonment

- 2,704 cases closed

The CDPP worked with 59 investigative agencies during the reporting period and received briefs of evidence from 46 investigative agencies across the nation.

Top referring agencies include:

- Australian Federal Police

- Department of Human Services

- Australian Taxation Office

- Department of Immigration and Border Protection

- Australian Securities and Investments Commission

Referrals from these agencies represent 80% of all matters.

SIGNIFICANT MATTERS

Together we contribute to a fair, safe and just society, where the laws of the Commonwealth are respected and there is public confidence in the justice system.

FRAUD

- More than $60 million fraud proven against the Commonwealth

Including:

- More than $28M tax fraud

- nearly $16M Centrelink fraud

- In excess of $500,000 other benefits fraud

COUNTER-TERRORISM

- 21 counter-terrorism matters before the courts

- 39 referrals during 2014–15

PEOPLE SMUGGLING

- 23 people smuggling matters before the courts

- 2 new referrals during 2014–15

SERIOUS DRUGS

- 263 convicted of serious drug offences under the Criminal Code

- Of those 90% were sentenced to gaol

TRANSMITTAL LETTER

30 September 2015

Attorney-General

Senator the Hon George Brandis QC

Parliament House

Canberra

Dear Attorney-General

I am pleased to present the annual report for the Commonwealth Director of Public Prosecutions (CDPP) for the year ended 30 June 2015.

Section 46 of the Public Governance, Performance and Accountability Act 2013 requires the Director of Public Prosecutions to prepare a report to the Attorney-General regarding the CDPP’s operations during the year.

This report has been prepared in accordance with section 63(1) of the Public Service Act 1999, which requires me to provide this report to you for presentation to the Parliament. It reflects the Requirements for annual reports for departments, executive agencies and other non-corporate Commonwealth entities (25 June 2015) as approved by the Joint Committee of Public Accounts and Audit.

In addition, I certify that the CDPP has prepared a fraud risk assessment and fraud control plan that complies with the requirements of the Commonwealth Fraud Control Framework 2014, and specifically section 10(b) of the Public Governance, Performance and Accountability Rule 2014. We have robust fraud prevention, detection, investigation, reporting and data collection procedures and processes in place that align with the principles outlined in the Australian Audit Office Better Practice Guide on Fraud Control in Australian Government Entities, 2011. We have taken all reasonable measures to minimise the potential incidence of fraud in the CDPP and to enable effective investigation and recovery of proceeds of any fraud against the CDPP.

Yours sincerely

Robert Bromwich SC

Commonwealth Director of Public Prosecutions

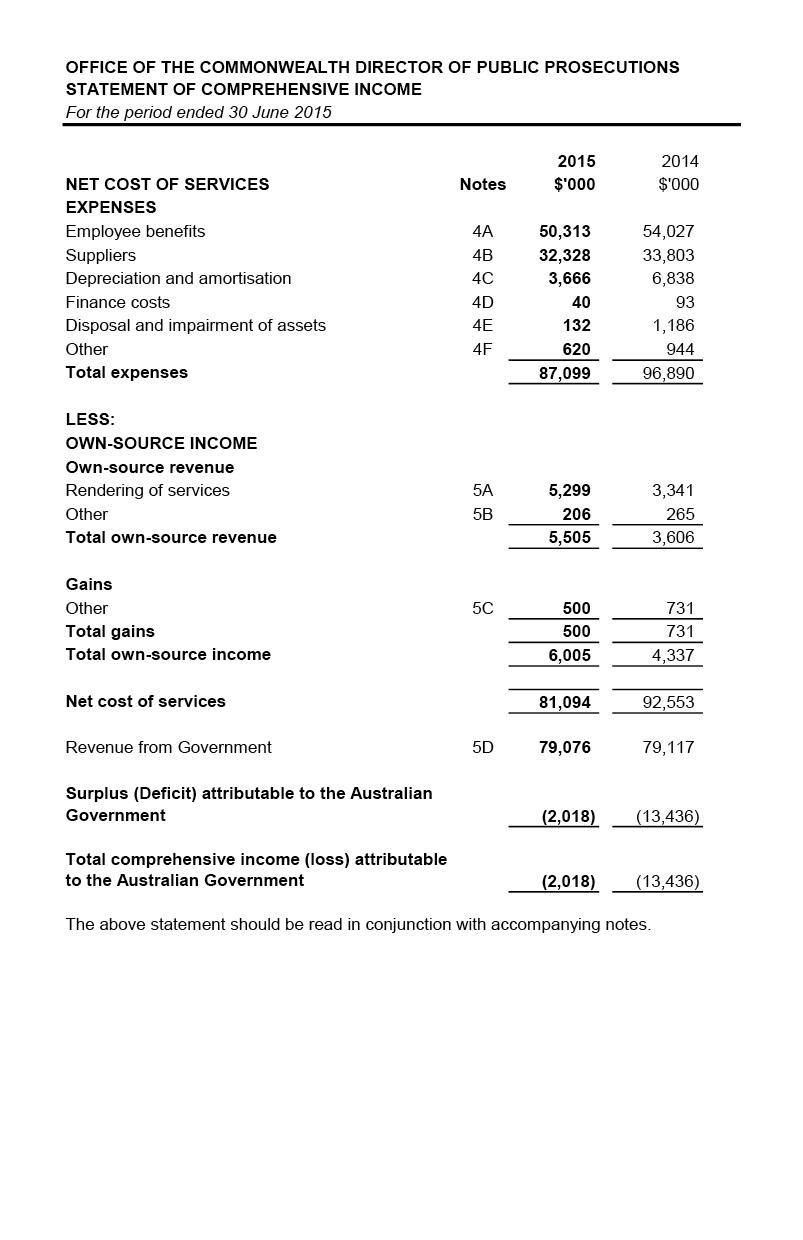

SUMMARY OF 2014–15 PERFORMANCE

Our Portfolio Budget Statement includes the outcome, programme, deliverables and key performance indicators against which we must report.

Outcome

Maintenance of law and order for the Australian community through an independent and ethical prosecution service in accordance with the Prosecution Policy of the Commonwealth.

Programme

An independent service to prosecute alleged offences against the criminal law of the Commonwealth, in appropriate matters, in a manner which is fair and just, and to ensure that offenders, where appropriate, are deprived of the proceeds and benefits of criminal activity.

Deliverable

To achieve the programme objectives, we will continue to deliver effective and timely prosecution services.

Results in 2014–15

In 2014–15 we met all prosecution performance indicators, including exceeding our target prosecutions resulting in conviction:

| Deliverable | Target | Outcome | Details |

|---|---|---|---|

| Prosecutions resulting in a conviction | 90% | 98% | 2,156 (out of a total of 2,209) |

Prosecution performance indicators

Our key performance indicators focus on providing public confidence in the justice system by providing effective and timely prosecution services. We continue to meet and exceed performance targets each year.

| Key performance indicator | Target | 2013–14 | 2014–15 |

|---|---|---|---|

| Prosecutions resulting in convictions | 90% | 98% | 98% |

Full details are in Chapter 4: Our Partnerships from page 70, Chapter 2: Our National Practice Areas from page 28 and Chapter 5: Our Performance from page 84.

DIRECTOR’S REVIEW

Transforming our organisation

2014–15 was a pivotal year for the Office of the Commonwealth Director of Public Prosecutions (CDPP). This was our first full year operating under a new national practice group model—based on legal practice groups comprising specialist teams in many locations dedicated to prosecuting specific categories of crime.

As well as transforming our national practice, we continued to modernise our systems and processes.

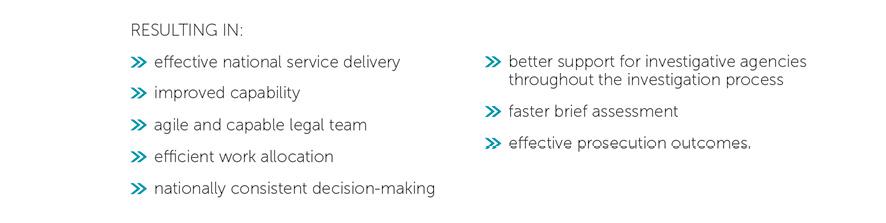

Our transformation has positioned the CDPP to meet the challenges of increasingly complex and expanded Commonwealth criminal law. It has led to immediate improvements, such as quicker decision-making and less internal red-tape, and is delivering benefits that will strengthen our position within the justice system into the future, including:

- more efficient, effective and nationally consistent federal prosecution services

- enhanced expertise of our Federal Prosecutors, who operate in courts at every level nationally

- strengthened relationships with our partners, supporting better briefs of evidence and improved prosecution outcomes, including greater encouragement of early guilty pleas

- improved sharing of information, expertise and knowledge.

Achieving successful prosecution outcomes

We achieved a 98 per cent conviction rate, with 2,156 out of 2,209 prosecutions resulting in convictions this year. A high conviction rate is a hallmark of a successful prosecution service. This has been achieved through high quality evidence assessment and effective charge selection and preparation ensuring a very high guilty plea rate. This has enabled case load and complexity to be balanced.

To indicate the range and diversity of our legal practice, cases were referred by 46 Commonwealth investigative agencies, as well as state and territory police. Cases included illicit drug and precursor importation, child internet pornography and other internet child sex offending, defrauding the government of tax or benefits, corporate crime, and a sharp increase in terrorism and related offences, as well as many other areas.

Building our capability

To continue to prosecute crimes against Commonwealth law successfully, we must ensure the conduct of our practice remains in step with society’s expectations. Our operating environment must also remain progressive to deliver a high performing CDPP. To this end, during the year we extensively reviewed our three functional areas—legal, administrative support, and corporate management. This led to 28 new Federal Prosecutor (Level 1) recruits joining our ranks, including recent graduates taking the first step in their legal careers. I am very pleased to provide these bright and dedicated young lawyers with an opportunity to work for the Commonwealth. While challenging, it is incredibly rewarding work and a real chance to make a difference.

To ensure we are properly resourced, we improved our internal reporting and legal case management tools. This has enabled us to analyse our legal work and develop evidence-based business cases to seek further funding to guide our recruitment and promotion activities and resource allocation. This will allow us to respond to the ever-changing work referred by our partner agencies. The drive to create an agile and flexible workforce has underpinned much of our planning.

Developing our leaders

Our leaders at all levels have played a critical role in advancing our major change agenda. We have expanded our investment in building our leadership capability. A tailored leadership programme was developed and implemented to improve our capability in the fundamental leadership areas of communication, change management, influence and learning agility, in turn helping to promote and support high performance.

Ensuring appropriate governance

As part of building our leadership capability, we must ensure our operating framework emphasises governance, accountability, performance and the appropriate use of public resources. Our reorganisation and the implementation of the Public Governance, Performance and Accountability Act 2013 and Rule 2014 have been foremost in our work in this area during 2014–15. This includes significant work reviewing our practices to ensure they align with government objectives and priorities, and contribute to achieving greater efficiencies and more effective outcomes.

Improving our prosecution services

In implementing our revised governance model we formed a National Best Practice Committee, drawing on and improving on past experience. The committee’s work has already resulted in significant improvements, in particular identifying and implementing best practice that is fundamental to our national operations and meeting our strategic directions.

Our prosecution services are influenced by this work, which brings together our expertise and organisational improvements to deliver tangible outcomes. For example, improved relationships with partner agencies are leading to better briefs of evidence, more efficient processing of work and more consistent outcomes, especially in sentencing.

Strengthening our partnerships

Staff at the CDPP recognise the importance of continually building on our strong collaborative relationships with our partner agencies. This remained a top priority during the year.

Our national practice group model better aligned our national liaison with partner agencies and the way we oversee cases they refer to us. Given our different roles and responsibilities, early engagement with our partner agencies is vital for better investigation and prosecution outcomes.

Throughout the year we were called on for advice, including scoping matters and providing qualified pre-brief advice. We are committed to improving this service as and when resources permit, recognising the clear and obvious direct correlation between the contribution this makes to improving the quality of the briefs we receive and our timeliness in assessing briefs and moving cases forward to a successful conclusion.

Our commitment to strong partnerships is evident in our contribution to multi-agency taskforces. Project Wickenby is a fine example of the value of partnering with other agencies to fight crime—in this instance, a joint effort targeting sophisticated tax crime. Our role was to prosecute successfully a large number of serious tax evasion matters, commonly using complicated domestic and overseas transactions and structures. This resulted in the imposition of substantial terms of imprisonment in many cases. Importantly, these prosecutions also sent a strong deterrent message—that no one is above the law and that tax fraud is a serious crime, which can attract severe punishment.

I thank all of our partner agencies for their focus and commitment—together we continue to build public confidence in the justice system and contribute to a fair, safe and just society.

Delivering better outcomes through appeals

Adequate sentencing for crimes committed remains an important part of my work at the CDPP. High level appeals demonstrate our commitment to ensure adequate sentencing for serious offending. I have spearheaded Crown appeals, especially in the areas of money-laundering, corporate offending and internet child exploitation offending. These successful appeals included non-custodial sentences being substituted with custodial ones, demonstrating the important role of intermediate appeal court decisions in discouraging this sort of offending, for the benefit of our society.

Educating the community

We are increasing our level of communication and engagement with the community. We recognise that bringing cases to a close through effective prosecution can serve as a strong deterrent. During the year we continued to publish case reports on our website to reinforce this strong message. This is in addition to working collaboratively with partner agencies to promote the work of joint taskforces, including Project Wickenby.

Promoting prosecution outcomes as a deterrent is one of our three objectives in strengthening our role in community education. The other two objectives are increasing public knowledge and understanding of Commonwealth criminal law and the consequences of breaking those laws.

Looking ahead

A highlight for the year ahead will be the appointment of the Commonwealth Solicitor for Public Prosecutions. This position will oversee the day-to-day running of the legal practice and help us embed our restructure while maintaining focus on building and enhancing our service delivery model to achieve effective prosecution outcomes and promote excellence in all that we do.

Also in the year ahead we will:

- build on our strong culture of integrity and service delivery

- work to achieve the outcomes set out in our Corporate Plan 2015–19

- continue to deliver effective prosecution outcomes in accordance with the Prosecution Policy of the Commonwealth

- actively participate in partner-led taskforce activity

- contribute to the Government’s law reform agenda

- increase the CDPP’s profile through ongoing community education

- deter potential offenders by promoting the consequences of criminal activity.

The important role of the CDPP in the justice system led to our staff receiving well-deserved accolades and awards from partner agencies this year. I would like to add my thanks to our staff, whose professionalism and dedication underpinned our achievements this year.

The next 12 months will be challenging—this is the nature of our work, especially in such a tight fiscal environment. However, I am confident we have the framework and sustainable structure in place to achieve our goal of contributing to a fair, safe and just Australia. It is important that I acknowledge that both past and future CDPP performance and success depends, as it always has done, on our talented, hard-working and dedicated staff.

I am pleased to present the CDPP Annual Report 2014–15.

Robert Bromwich SC

Commonwealth Director of Public Prosecutions

‘2014–15 was a pivotal year for the Office of the Commonwealth Director of Public Prosecutions. This was our first full year operating under our new national practice model. Our transformation has positioned the CDPP to meet the challenges of increasingly complex and expanded Commonwealth law.’ Robert Bromwich SC

1 ABOUT US

The Office of the Commonwealth Director of Public Prosecutions (CDPP) is an independent prosecution service established by Parliament to prosecute alleged offences against Commonwealth law.

The CDPP was established under the Director of Public Prosecutions Act 1983 (the DPP Act) and began operations on 5 March 1984.

Our work

We deal with diverse matters reflecting the evolving and expanding nature of offences against Commonwealth law. Our prosecutions are often complex and feature international transactions and overseas evidence, reflecting the often global nature of Commonwealth offending.

We prosecute a wide range of matters including terrorism, serious drug offences, money laundering, human trafficking and slavery, people smuggling, child exploitation, cybercrime, revenue and benefit fraud, corporate and commercial offending, regulatory non-compliance, public and workplace safety, environmental crimes, corruption, unlawful disclosure of information, copyright offences, perjury, and failing to vote.

In addition, we take action to confiscate the proceeds of crime following conviction and we are responsible for prosecuting offences against the laws of Jervis Bay and Australia’s external territories, other than Norfolk Island.

We also provide legal advice to Commonwealth investigators and apply for superannuation forfeiture orders under Commonwealth law.

Our aim

Our independent prosecution service contributes to a fair, safe and just Australia where Commonwealth laws are respected, offenders are brought to justice and potential offenders are deterred.

To achieve our aim, we will:

- be fair, consistent, ethical and professional in everything we do

- recognise, value and develop the knowledge, skills and commitment of our people

- work efficiently and effectively, in accordance with the Prosecution Policy of the Commonwealth

- work collaboratively with our partner agencies to assist them in advancing their goals and priorities in bringing their investigations to conclusion, through prosecutions

- treat victims of crime with courtesy, dignity and respect

- provide information to the public about Commonwealth criminal law and prosecutions.

The Office is under the control of the Director, who is appointed for a term of up to seven years. Our current Director, Robert Bromwich SC, was appointed on 17 December 2012 for a term of five years.

Directions or guidelines to the Director

The CDPP is within the Commonwealth Attorney-General’s portfolio, but we operate independently of the Attorney-General and the political process. The Commonwealth Attorney-General has power under section 8 of the DPP Act to issue directions or guidelines to the Director. Directions or guidelines must be in writing and tabled in Parliament, and there must be prior consultation between the Attorney-General and the Director. Only seven directions have been issued in over 30 years, with one issued during the reporting period.

On 30 October 2014 the Attorney-General, Senator the Hon George Brandis QC issued a section 8 direction to the Director requiring the Director not to proceed with a prosecution of a person for alleged contravention of section 35P of the Australian Security Intelligence Organisation Act 1979 and sections 15HK, 15HL and 3ZZHA of the Crimes Act 1914, without the written consent of the Attorney-General where the person is a journalist and the facts constituting the alleged offence relate to the work of the person in a professional capacity as a journalist.

Our organisation

We are a Commonwealth statutory agency with 425 staff working in offices in Canberra, Sydney, Melbourne, Perth, Adelaide, Hobart, Darwin, Brisbane, Townsville and Cairns.

Our organisational structure reflects our national practice model, with areas of legal practice prosecuting specific categories of crime.

FIGURE 1: ORGANISATION CHART AT 30 JUNE 2015

Our Executive Leadership Group

The Executive Leadership Group (ELG) is the key advisory group to the Director. The ELG comprises Deputy Directors and the Chief Corporate Officer and advises on:

- strategy

- policy

- planning

- practice management

- corporate management

- performance reporting

- significant issues of national interest to the Office.

Members of the Executive Leadership Group, left to right: James Carter, Scott Bruckard, Robert Bromwich SC, David Adsett, Gaby Medley-Brown, Shane Kirne. Graeme Davidson not pictured.

Robert Bromwich SC

Commonwealth Director of Public Prosecutions

Robert Bromwich SC was appointed Commonwealth Director of Public Prosecutions following a lengthy legal career in both public and private practice. Robert commenced his career in private practice before specialising in Commonwealth law over a 12 year term at the CDPP in Sydney. He then practised for 15 years as a barrister at the private Bar in NSW where he took silk in September 2009. His private practice experience is diverse and covers investigative powers advice, prosecuting and defending lengthy and complex criminal jury trials, inquests and inquiry work, as well as judicial review proceedings and appeals, and other more general criminal law work. Robert was appointed as Director in December 2012 for a five year term. He has worked to transform the CDPP legal practice through the implementation of a national practice group model based on crime categories, and has instigated the modernisation of support services to underpin the legal practice of the CDPP into the future.

Gaby Medley-Brown

Chief Corporate Officer

Gaby is an accomplished Chief Corporate Officer (CCO) with over five years’ experience in successfully leading all facets of Corporate Services. Gaby’s experience includes the leadership and stewardship of human resources management, information technology and information management, finance, governance audit and risk, property and security services, communication, media, parliamentary services and legal services. Before joining the CDPP, Gaby was Chief Operating Officer at Comcare (2010-2014)—a position she gained after more than 17 years’ designing, implementing and running large information communication technology environments including as the ICT National Operations Manager for Medicare Australia (2005-2010). Gaby is an alumnus of the Harvard Business School’s Advanced Management Program (2013).

Shane Kirne

Deputy Director Commercial, Financial and Corruption

Shane Kirne has been a key member of the CDPP since 1985. As a Federal Prosecutor Shane has had an interesting and diverse career prosecuting crimes against the Commonwealth. Shane has personally handled and/or managed a diverse range of matters, including large and complex drug matters, complex commercial fraud and market manipulation matters, and prosecution of frauds committed against the Commonwealth or by Commonwealth employees, including fraud committed by a member of federal parliament. Shane’s knowledge and experience is highly regarded. He is regularly invited to speak at legal forums to share his knowledge of commercial crimes and their prosecution—inspiring the next generation of lawyers to consider a career specialising in Commonwealth law. Shane holds a Bachelor of Laws [Hons] and a Bachelor of Arts from the University of Melbourne. He is admitted as a Barrister and Solicitor of the Supreme Court of Victoria.

James Carter

Director Revenue and Benefits Fraud

James Carter commenced his legal career at the CDPP as a graduate legal officer in 1987. James prosecuted in the ACT and NSW before moving to national legal, liaison, law reform and practice management roles. James has extensive experience in Commonwealth criminal law and working with partner agencies to successfully investigate and prosecute the wide range of Commonwealth criminal offences. James has contributed to the work of the Australian Law Reform Commission, particularly in relation to the sentencing of federal offenders. James’ experience led to his leadership of the Revenue and Benefits Fraud Practice group. In this role he is responsible nationally for the prosecution of general tax, social security, internal and identity fraud, to protect the integrity of Commonwealth programmes. James has been a member of the Senior Executive of the CDPP since 2004 and a Deputy Director since 2007. James has degrees in Law and Arts from the Australian National University.

Graeme Davidson

Deputy Director of International Assistance and Specialist Agencies

Graeme joined the Attorney-General’s Department in 1980 to work for the Deputy Crown Solicitors Office where he completed rotations in the International Trade Law area and Crown Solicitors Division. After transferring to the Commonwealth Director of Public Prosecutions in 1985 to conduct Australian Capital Territory prosecutions and liaison work, he became responsible for prosecuting corporate crime under the then new Corporations Law Regime (1991). In 2004 Graeme was assigned the international functions of extradition and mutual assistance and was also responsible for overseeing the counter-terrorism function. In 2012 Graeme was invited to be a member of the COAG committee to review counter-terrorism legislation. Graeme underpins his legal career with a Bachelor of Economics/Law from the Australian National University and qualifications from the College of Law in Sydney.

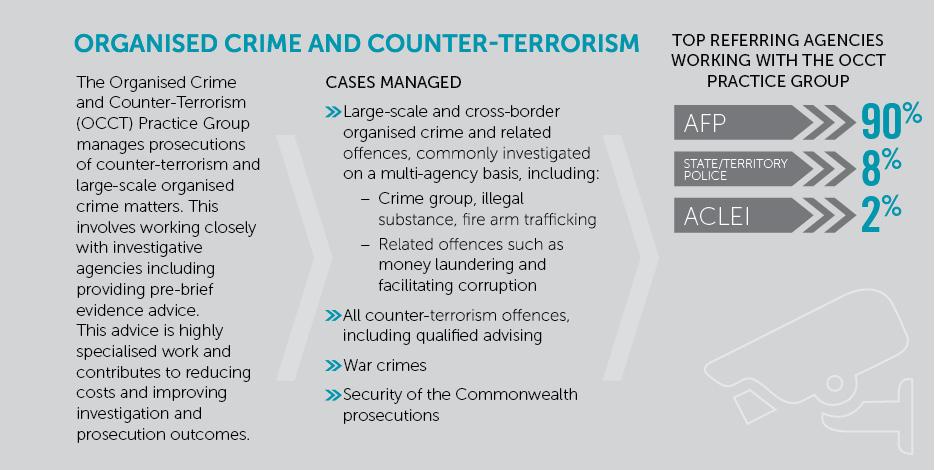

Scott Bruckard

Deputy Director Organised Crime and Counter-Terrorism

Scott has worked as a Federal Prosecutor for over 27 years prosecuting a wide range of crime types. Since 2004 Scott has specialised in the prosecution of counter-terrorism matters. He has managed some of Australia’s largest and high profile cases including the prosecution of Jack Thomas and the numerous prosecutions arising out of AFP Operation Halophyte, Operation Neath and Operation Pendennis — Australia’s largest counter-terrorism police investigation. In Scott’s current portfolio he oversees the delivery of specialist legal services to police and other partner agencies during the course of counter-terrorism and more complex organised crime investigations. Scott has a strong interest in developing better ways to manage large criminal litigation, particularly through more effective partnerships and smarter use of technology. Scott has represented Australia at a number of international counter-terrorism conferences and forums, including at the United Nations in New York and at a Global Counter-Terrorism Forum in Frankfurt. He holds degrees in Arts and Law from the University of Melbourne.

David Adsett

Deputy Director Illegal Imports/Exports and Human Exploitation and Border Protection

David has been a Federal Prosecutor for almost 30 years. During his extensive legal career he has conducted prosecutions for a wide range of Commonwealth offending, including money laundering, tax fraud, commercial fraud, drug importation, people smuggling and terrorism. David’s current portfolio includes child exploitation matters. This involves leading a team of highly skilled lawyers to see offenders brought to justice and potential offenders deterred through effective sentencing. David is a Barrister and holds Law and Arts degrees from the University of Queensland and a Master of Laws degree from the University of Sydney.

We deal with diverse matters reflecting the evolving and expanding nature of offences against Commonwealth law.

Our partnerships

We prosecute in each state and territory—working with 59 investigative agencies across the nation. For details about working with our partners, see Chapter 4: Our Partnerships from page 71.

The prosecution policy

The Prosecution Policy of the Commonwealth applies to all Commonwealth prosecutions. It outlines the principles, factors and considerations our prosecutors must take into account in prosecuting offences against the laws of the Commonwealth.

This policy underpins our decisions throughout the prosecution process and promotes consistency in decision-making. It is available on our website at www.cdpp.gov.au

Two-stage test

The Prosecution Policy of the Commonwealth provides a two-stage test that must be satisfied before a prosecution commences:

- There must be sufficient evidence to prosecute the case.

- It must be evident from the facts of the case, and all the surrounding circumstances, that the prosecution would be in the public interest.

In determining whether there is sufficient evidence to prosecute a case, we must be satisfied that there is prima facie evidence of the elements of the offence, and a reasonable prospect of obtaining a conviction.

In making this decision, our prosecutors must evaluate how strong the case is likely to be when presented in court. They must take into account matters such as the availability, competence and credibility of witnesses, their likely effect on the arbiter of fact, and the admissibility of any alleged confession or other evidence. They also consider any lines of defence open to the alleged offender and any other factors that could affect the likelihood of a conviction.

Our prosecutors also need to consider if any evidence might be excluded by a court. If that evidence is crucial to the case, this may substantially affect the decision whether or not to prosecute. Prosecutors need to look beneath the surface of the evidence in a matter, particularly in borderline cases.

Once satisfied there is sufficient evidence to justify the initiation or continuation of a prosecution, our prosecutors must then consider whether pursuing a prosecution is in the public interest. This involves considering all provable facts and surrounding circumstances. Public interest factors vary from case-to-case and may include:

- whether the offence is serious or trivial

- any mitigating or aggravating circumstances

- the youth, age, intelligence, physical health, mental health or special vulnerability of the alleged offender, witness or victim the alleged offender’s antecedents and background

- the passage of time since the alleged offence

- the availability and efficacy of any alternatives to prosecution

- the prevalence of the alleged offence and the need for general and personal deterrence

- the attitude of the victim

- the need to give effect to regulatory or punitive imperatives

- the likely outcome in the event of a finding of guilt.

All relevant factors are contained in the Prosecution Policy of the Commonwealth.

Generally, the more serious the alleged offence, the more likely the public interest will require a prosecution to be pursued. The decision to prosecute must be made impartially and must not be influenced by any inappropriate reference to race, religion, sex, national origin or political association. The decision to prosecute must not be influenced by any political advantage or disadvantage to the government.

In September 2014 we amended Annexure B of the Prosecution Policy of the Commonwealth. This deals with Immunity from Prosecution in Serious Cartel Offences. The amendment coincided with the release of the Australian Competition and Consumer Commission’s Immunity and cooperation policy for cartel conduct, and streamlines our decision-making about applications for immunity from prosecution under Annexure B.

Links with state and territory Directors of Public Prosecutions

We have arrangements in place with each Director of Public Prosecutions in Australia concerning procedures for conducting trials that involve both Commonwealth and state or territory offences.

The Commonwealth Director of Public Prosecutions can prosecute indictable offences against state and territory laws where the Director holds an authority to do so under the laws of the relevant jurisdiction. In addition, the Director can conduct committal proceedings and summary prosecutions for offences against state or territory law where a Commonwealth officer is the informant.

Liaison between Commonwealth and state prosecuting authorities occurs at both the national and regional level. The Conference of Australian Directors of Public Prosecutions is a forum for Directors to discuss best practice in prosecuting, professional standards, training and liaison.

Another valuable forum is the National Executive Officers’ Meeting of the heads of legal practice and corporate services of Commonwealth, state and territory prosecution services. Through this forum we share information and discuss the management of prosecuting agencies.

Our outcome and programme structure

As set out in government Portfolio Budget Statements, our 2014–15 outcome statement is the intended result, impact or consequences of our actions, while our programme is the way in which we achieve our intended outcome.

Our outcome is:

Maintenance of law and order for the Australian community through an independent and ethical prosecution service in accordance with the Prosecution Policy of the Commonwealth.

Our programme is:

An independent service to prosecute alleged offences against the criminal law of the Commonwealth, in appropriate matters, in a manner which is fair and just and to ensure that offenders, where appropriate, are deprived of the proceeds and benefits of criminal activity.

Other functions

The Director also has a number of miscellaneous functions, including to:

- provide legal advice to Commonwealth investigators

- apply for superannuation forfeiture orders under Commonwealth law.

Social justice and equity

The CDPP advances the interests of social justice and equity by working with partner agencies to enforce criminal law for the benefit of the community. We recognise the importance of adopting the highest professional and ethical standards in prosecutions and in seeking orders under proceeds of crime legislation. The Prosecution Policy of the Commonwealth underpins all the decisions we make throughout the prosecution process and promotes consistency in decision-making (see page 24 for more details).

We work to ensure that alleged offenders and other people affected by the criminal justice process are treated fairly. To support our contribution to the criminal justice system, we take action to promote and maintain an organisational culture that values fairness, equity and respect. We expect conduct from our employees that reflects high ethical standards. We have issued Guidelines on Official Conduct for CDPP employees setting out the ethical standards expected of them. All CDPP employees have signed a copy of this document.

Victims

Traditionally, much of our work has not involved crime directed at individual victims. However, as the nature of Commonwealth crime changes, we are prosecuting an increasing number of matters that involve individual victims of crime. This includes areas such as online child sexual exploitation, child sex offences committed overseas by Australians, human trafficking, servitude and slavery.

Victims of offences against Commonwealth law have an important place in the criminal justice system, and we recognise the importance of providing appropriate support and information to victims participating in the criminal justice process.

Our Prosecution Policy of the Commonwealth states the importance of treating victims with respect and dignity in all prosecution actions. In this context, a victim of crime is an identified individual who has suffered harm as the direct result of an offence or offences committed against Commonwealth law or prosecuted by Commonwealth authorities. ‘Harm’ includes physical or mental injury, emotional suffering and economic loss.

The Prosecution Policy of the Commonwealth provides for the views of any victims—where those views are available, and where it is appropriate—to be considered and taken into account when deciding whether it is in the public interest to:

- commence a prosecution

- discontinue a prosecution

- agree to a charge negotiation

- decline to proceed with a prosecution after a committal.

The Prosecution Policy of the Commonwealth also requires us to comply with our Victims of Crime Policy in our dealings with victims.

We have produced documents about the prosecution process that may be of assistance to victims, such as a step-by-step guide to the prosecution process, a guide to witnesses giving evidence in court, a glossary of commonly used terms, and questions and answers for victims and witnesses.

Witness Assistance Service

Our Witness Assistance Service (WAS) is a national service provided out of our Sydney office. This service ensures we provide appropriate information and support to the most vulnerable victims and witnesses involved in matters we prosecute.

WAS Referral Guidelines, contained in a National Legal Direction, require that all identifiable child victims and victims of slavery, sexual servitude and forced marriage offences are referred to the WAS. The aim is to ensure the most vulnerable victims of Commonwealth crime are treated in an appropriate and consistent manner.

During the reporting period, the WAS received its 1000th victim/witness referral since it was established in late 2008. These referrals have included over 300 children and young people, the majority of whom have been involved in online child exploitation offences.

Our WAS staff provide a range of information and support services including updates on the progress of a prosecution, general information about the prosecution process, court tours, referrals to support services, support at court and during conferences with legal staff and information concerning victim impact statements.

Resources for victims including WAS Referral Guidelines are available on our website at www.cdpp.gov.au.

Business regulation

We have no direct role in business regulation other than to prosecute criminal offences in appropriate cases. Our activities in the area of commercial, financial and corruption prosecutions are reported in Chapter 3: Our National Practice Groups of this report.

Public comment

Any person is free to write to us at the addresses shown at the back of this report. Alternatively, they can email any comments, suggestions or queries about the Office of the CDPP and our functions to inquiries@cdpp.gov.au.

2 OUR NATIONAL PRACTICE AREAS

Supporting our legal practice

Our organisation is structured to support our national legal practice. Our Director is supported by the Director’s Coordination Unit which provides a range of strategic and liaison services.

For our national legal practice groups, relevant committees have been established to provide oversight and encourage best practice, while a communication team has been established to raise the profile of the CDPP. It has become increasingly important to publicise our successful prosecution outcomes to raise the profile of the work of the CDPP and send a strong message of deterrence.

Behind the scenes, our information technology and information management teams have taken steps to modernise our systems and processes.

These different aspects of our national practice work together to contribute to a high performing CDPP.

National practice groups

Embedding our national practice group model this year has enabled us to further build our expertise, ensure national consistency, and be more responsive to the priorities of investigation agencies.

The benefits include improved information sharing around the country, established networks for prosecutors working in specialised areas, provision of online legal resources for our staff and our partner agencies and nationwide meetings.

The national practice group model also enables us to work more efficiently with specialist agencies that provide fewer referrals.

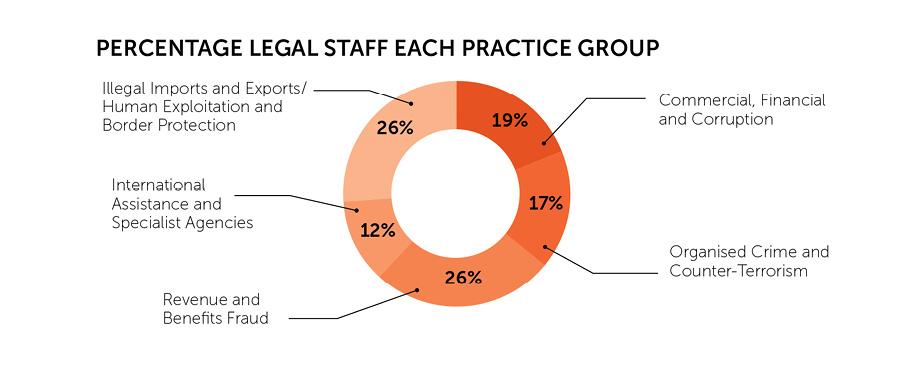

Our prosecutors appear in all levels of the courts around Australia at all stages of the prosecution process. We carry out this work through six national practice groups based on compatible crime types. Refer to table 1 on page 31.

Practice Group Leaders

Each Deputy Director is a Practice Group Leader for particular crime types covered by their practice group across Australia. In 2014–15 one Practice Group Leader was responsible for two practice groups following a reduction in the total number of Practice Group Leaders from six to five. The Practice Group Leaders deal with a broad range of legal, policy and liaison responsibilities in relation to the prosecution work of their practice group. This includes providing legal and strategic advice in significant and sensitive prosecutions; responsibility for national liaison with partner agencies; coordinating the review of national policies and issuing guidelines relevant to the work of the practice group.

The Practice Group Leaders also provide high-level legal advice to the Director on matters within their practice groups and the exercise of the Director’s statutory functions in accordance

with the Prosecution Policy of the Commonwealth. Statutory functions include consideration of no Bills, ex officio indictments, appeals against sentence, reference appeals, conspiracy consents and taking over and discontinuing prosecutions. Responsibility for a number of statutory functions has been delegated to Practice Group Leaders or senior staff within a practice group and this is supporting efficient and effective decision making in the course of litigation.

Feedback from our partner agencies indicates that these are welcome changes and have contributed to improving collaborative efforts.

| Commercial, Financial and Corruption | Revenue and Benefits Fraud |

|---|---|

|

|

| International Assistance and Specialist Agencies | Organised Crime and Counter–Terrorism |

|---|---|

|

|

| Illegal Imports and Exports | Human Exploitation and Border Protection |

|---|---|

|

|

Director’s Coordination Unit

The Director’s Coordination Unit is responsible for developing organisational strategy and planning to support the effective and efficient delivery of prosecutorial services and to advise the Director on national issues that fall outside the practice group areas. It also provides coordination support to the Deputy Directors in their capacity as Practice Group Leaders.

In practical terms the Director’s Coordination Unit is responsible for:

- providing legal and other support to the Director

- contributing to the executive management and governance of the CDPP

- developing internal and external policies relating to legal work within the CDPP

- providing legal and strategic advice in significant and sensitive matters and independent assessment and input

- managing delegations and authorisations in the legal area and Joint Trial arrangements with the states and territories in jointly prosecuting Commonwealth and state offences

- contributing to and progressing law reform proposals which have general CDPP application and do not exclusively fall within a particular practice group’s area of responsibility.

Federal Counsel Group

As part of the move to a national practice group model, we established a national specialist in-house advocacy programme for the CDPP, called the Federal Counsel Group.

The programme comprises a specialist group of advocates capable of regularly conducting federal criminal jury trials, superior court appeals and other more challenging and complex appearance work that would otherwise be briefed to the private bar.

Staff participating in the programme initially commit to a three-year term to develop the skills necessary to carry out this complex work.

The programme generates financial savings for the CDPP and promotes the development of highly specialised advocacy skills offering staff a specialist career path.

Communications and engagement

During the reporting period we established a Communications Team and the necessary framework to strengthen and support a more proactive approach to CDPP communications and community engagement.

Promoting joint outcomes

The Communications Team has connected with counterparts in partner agencies to proactively contribute to taskforce-specific initiatives and collaborate when prosecutions attract media attention. This has included promoting the outcome of coordinated investigation and prosecutions as an important way of communicating with the public.

We publish case reports highlighting the areas of practice as a valuable resource reflecting the diversity of our work across jurisdictions and practice areas. These reports are on our website at www.cdpp.gov.au.

Working with the media

The CDPP recognises the importance of working to improve community awareness of our work and the important role we play in the justice system. We manage daily media enquiries from national media, and at times international media. We have established effective processes to support accurate reporting of prosecution outcomes.

Digital communication platform improvements

Promoting prosecution outcomes to educate the community about the serious consequences for individuals convicted of crimes committed against the Commonwealth sends a strong message that serious crime will not be tolerated.

Recognising the importance of this, we enhanced the CDPP website to promote popular content and case studies. We will make further improvements to the website as an important channel to reach the general public.

Information management support services

Information technology

Our computing environment comprises a national network covering all CDPP offices across the country. During the reporting period we commenced a full review of our information technology capability to:

- benchmark the level and cost of existing services

- assess the readiness of the computing environment for our future requirements including:

- mobile computing

- legal case management

- financial, and human resources management and payroll systems

- develop a strategy towards right-sourcing computing in accordance with the Australian Government Cloud Computing Policy—Smarter ICT Investment.

We also made significant progress in other areas this year including:

- restructuring our information technology resources

- modernising all second tier computing equipment to ensure full compliance with Information Security Management standards by the end of 2015

- enhancing internal video conferencing

- implementing a strategy to migrate the CDPP to digital information and records management for efficiency purposes under the Australian Government Digital

Transformation Policy.

Information management

Our library and records management service is governed by the CDPP Library Strategic Directions and Information Asset Policy. This ensures that our federal prosecutors have high-level legal research support and access to an extensive range of online services and print materials to keep them up-to-date about legal developments and legislative changes.

Our prosecutors appear in all levels of courts around Australia at all stages in the prosecution process.

3 OUR NATIONAL PRACTICE GROUPS

Commercial, Financial and Corruption

The Commercial, Financial and Corruption Practice Group Leader is Shane Kirne, Deputy Director.

This practice group is responsible for prosecuting the more complex cases of ‘white collar’ crime, with a focus on crimes involving money, corporations and financial markets. This includes:

- all referrals from the Australian Securities and Investments Commission (ASIC), from market integrity offences such as insider trading and market manipulation, to breaches of directors/officers’ duties, dishonest conduct by financial service providers and many regulatory offences

- all referrals from the Australian Competition and Consumer Commission (ACCC), including serious cartel offences (for example, where businesses agree with their competitors to fix prices, rig bids, share markets or restrict outputs for goods or services)

- all referrals from the Australian Prudential Regulation Authority (APRA)

- complex and large-scale tax fraud, often involving international transactions and opaque corporate structures such as those previously investigated under Project Wickenby

- large-scale finance-related money laundering (often associated with major tax fraud)

- bribery of foreign public officials, abuse of public office and other major corruption cases involving Commonwealth public officials.

Typically, we prosecute offences under the Criminal Code (Cth), the Corporations Act 2001, the Australian Securities and Investments Commission Act 2001, the National Consumer Credit Protection Act 2009, the Competition and Consumer Act 2010, and related state or territory offences. These types of offences can be very difficult to detect, investigate and prosecute but they can have devastating financial and personal consequences for individuals, businesses and indeed communities.

Early engagement

The Commercial, Financial and Corruption Practice Group prosecutes many of the most complex matters we deal with. As a result an important part of our work is pre-brief advice to investigating agencies on matters such as the elements of an offence, evidentiary issues or potential further lines of inquiry. This helps to ensure that investigations

are conducted in a strategic, efficient and effective manner.

There is a growing trend for some agencies to refer matters to us before a full brief of evidence has been compiled, to explore whether an accused person is willing to enter an early plea of guilty and, if so, to identify charges which adequately reflect the criminality alleged. Where appropriate, the early resolution of matters can result in significant savings of time and money for the Government and the community.

Practice Group structure

As at 30 June 2015 the Commercial, Financial and Corruption Practice Group comprised two branches—one in Sydney and one in Melbourne—which dealt primarily with the work of the practice group. Other offices across Australia that receive and conduct Commercial, Financial and Corruption Practice Group work as required are located in Adelaide, Brisbane, Canberra, Hobart and Perth.

Partner agencies

Partner agencies that refer work to the Commercial, Financial and Corruption Practice Group are the Australian Crime Commission, the Australian Competition and Consumer Commission, the Australian Federal Police, Australian Prudential Regulation Authority, Australian Securities and Investments Commission, and the Australian Taxation Office. This is also the lead Practice Group for all national liaison with the Australian Crime Commission, the Australian Competition and Consumer Commission, and the Australian Prudential Regulation Authority.

Developments this year

Project Wickenby

We have played a central role in advising investigative agencies and prosecuting matters referred under Project Wickenby since it was established in 2006. This Commonwealth cross-agency taskforce focused on complex tax fraud with offshore elements. After nine years, the allocation of special funding for Project Wickenby came to an end on 30 June 2015.

In its final year, Project Wickenby continued to deliver results. We received one new matter, completed 14 and ended the year with 19 matters open/ongoing. A total of 61 people have been committed to trial for indictable offences to date, with 46 convicted of one or more indictable offences, all receiving a custodial sentence.

For more details about the Wickenby legacy, see the case study on page 80.

Serious Financial Crime Taskforce

During the year the Government announced the multi agency Serious Financial Crime Taskforce, which will lead the Commonwealth operational response to high priority serious financial crimes from 1 July 2015. Ongoing Wickenby prosecutions will be managed within the Serious Financial Crime Taskforce.

The overall objective of the new taskforce is to maintain integrity and community confidence in the Australian economy, financial markets, regulatory framework and collection of revenue. The taskforce includes the Australian Federal Police, Australian Taxation Office, Australian Crime Commission, Attorney-General’s Department, Australian Transaction Reports and Analysis Centre, Australian Securities and Investments Commission, and Australian Customs and Border Protection Service and the CDPP.

Key priorities over the next two years include investigations into serious offshore tax evasion, and criminality related phoenix activity and trusts.

Foreign bribery

We are currently prosecuting two matters relating to allegations of foreign bribery, contrary to section 70.2 of the Criminal Code.

The first matter relates to an allegation that individuals associated with two companies—Securency International Pty Ltd (a company half owned by the Reserve Bank of Australia) and Note Printing Australia (a company wholly owned by the Reserve Bank of Australia)—used agents to bribe foreign officials in various countries that purchased polymer substrate for the manufacture of bank notes, from as far back as 1999. These allegations have been widely reported in the media. However, because the prosecution is ongoing and various suppression orders apply, it is not appropriate for us to report further.

The second matter relates to an allegation of foreign bribery in connection with large, government-funded construction projects in Iraq.

Immunity framework for serious cartel conduct

Annexure B of the Prosecution Policy of the Commonwealth outlines our policy in considering applications for immunity from prosecution by parties implicated in a serious cartel offence, who meet the criteria for conditional immunity under the Australian Competition and Consumer Commission’s Immunity and cooperation policy for cartel conduct. A serious cartel offence refers to the offences in sections 44ZZRF and 44ZZRG of the Competition and Consumer Act 2010 and the corresponding offences in the state and territory Competition Codes.

Our policy is based on the Government’s recognition that, regarding serious cartel offences, it is in the public interest to offer immunity from prosecution to a party who is willing to be the first to break ranks with other cartel participants by exposing the illegal conduct and fully cooperating with us and with the Australian Competition and Consumer Commission.

In September 2014, we amended Annexure B to streamline our internal processes for dealing with immunity applications. Previously, all parties who met the criteria for criminal immunity under Annexure B were provided with a written undertaking under s9(6D) of the Director of Public Prosecutions Act 1983 (DPP Act). The amendment means that from September 2014, the Deputy Director (Commercial, Financial and Corruption) would first issue a ‘letter of comfort’ then, before commencing any prosecution, the Director would grant a formal undertaking pursuant to section 9(6D) of the DPP Act.

The impact of the decision in Lee

On 21 May 2014 the High Court delivered its judgment in the matter of Lee v R (2014) 253 CLR 455; [2014] HCA 20. The issue in Lee was that, prior to trial, the appellants were compulsorily examined by the New South Wales Crime Commission about matters directly relating to criminal charges then pending against them, as well as matters relating to serious drugs charges that were also anticipated. The appellants were subsequently convicted of those charges. On appeal, the High Court held that the dissemination of the examination material to the prosecution was, in the circumstances, unlawful and had fundamentally altered the trial of the appellants. The High Court ordered the appellants’ convictions be quashed and a new trial be held.

This decision has raised important questions about the scope of similar compulsory powers vested by legislation in a number of Commonwealth investigating agencies, such as the Australian Crime Commission and the Australian Securities and Investments Commission, and when material obtained or derived from exercising those powers can be lawfully disseminated to the prosecution team.

The resulting legal uncertainty has generated a large number of defence challenges, including applications for temporary and permanent stays of prosecutions. Meeting these challenges has been resource intensive for the Commercial, Financial and Corruption Practice Group, leading to considerable delays in many matters.

In response to some of the issues raised by Lee, Parliament enacted the Law Enforcement Legislation Amendment (Powers) Act 2015, which commenced on 28 July 2015, just outside the reporting period. We were consulted in the drafting process for this Act.

Policy engagement and law reform

During the reporting period the Commercial, Financial and Corruption Practice Group participated in a number of significant law reform and broader policy processes, including:

- the drafting of the Law Enforcement Legislation Amendment (Powers) Act 2015, referred to above

- the Senate Legal and Constitutional Affairs Legislation Committee’s Inquiry into the Law Enforcement Legislation Amendment (Powers) Bill 2015

- the five-year independent review of the Australian Crime Commission

Act 2002 - Australia’s response to the Organisation for Economic

Co-operation and Development (OECD) Working Group on Bribery’s Phase 3 Report on Implementing the OECD Anti-bribery Convention

in Australia - a proposal to introduce a new Commonwealth offence of false accounting to strengthen Australia’s legislative framework for dealing with foreign bribery

- the Government’s response to the Final Report of the Competition Policy Review (‘Harper Review’), which recommended simplifying and narrowing the cartel offences in the Competition and Consumer Act 2010.

We were also consulted by the Australian Competition and Consumer Commission about the changes to its Immunity and Cooperation Policy for Cartel Conduct, referred to above. In addition, the Practice Group Leader delivered numerous seminars to whole-of-government and public audiences on issues of Commonwealth law and policy arising within the practice group.

International assistance and engagement

The Director, Robert Bromwich SC, attended the International Competition Network Annual Meeting, hosted by the Australian Competition and Consumer Commission, from 28 April to 1 May 2015 in Sydney. During the meeting, the Director also met with counterparts from the United States and Canada to discuss international prosecution policy and practice regarding serious cartel conduct.

Assistant Director, Ms Carolyn Davy, presented at the Judges Dialogue on Anti-Money Laundering held from 19 to 21 May in Medan, Indonesia. The Dialogue was co-hosted by the Australian Attorney-General’s Department and the Indonesian Corruption Eradication Commission. It focused on anti-money laundering and asset recovery in the context of corruption investigations and prosecutions.

The Commercial, Financial and Corruption Practice Group is responsible for prosecuting what is typically referred to as ‘white collar’ crime. They focus on crimes involving money, corporations and financial markets.

CASE STUDY

PRISON FOR DUO BEHIND $7 MILLION INSIDER TRADING CASE

Former banker, 26-year-old Lukas Kamay and former Australian Bureau of Statistics worker, 25-year-old Christopher Hill have both been sentenced to significant gaol terms for their roles in what is one of the biggest insider trading cases in Australian history—worth over $7 million in illegal foreign exchange trades.

The plan

Kamay and Hill met in 2007 at Monash University in Victoria where they were studying commerce and economics. They both graduated in 2011.

In 2013, during a casual catch up at a Fitzroy North pub, Hill agreed to use his position at the Australian Bureau of Statistics (ABS) in Canberra to send Kamay sensitive and unpublished ABS main economic indicators. This data about Australia’s labour force, retail trade, building approvals and private expenditure is inside information not generally available to the public until official publication.

The plan was simple and followed a similar pattern each time. Hill obtained the ABS economic indicator information in his capacity as a Commonwealth public official. He accessed the data within the ABS, recorded the data in handwritten notes, and removed it from the ABS. Hill would then pass the key or main economic indicator information to Kamay via their mobile phones.

Kamay traded on the foreign exchange (FX) derivatives market, using the information not generally available to the wider public. This had a material effect on the price or value of the foreign exchange derivative contracts when the information became public.

The pair knew this information could make them a lot of money. The plan was to make around $200,000 profit, but Kamay ended up concealing millions.

Unknown to Hill, Kamay set up three secret trading accounts and made more than $7 million.

Fearing detection, Kamay attempted to conceal his offending by losing money on some occasions.

In April 2014, he successfully bid $2,375,000 at auction for a three-bedroom Albert Park loft featured on the Channel 9 TV series, The Block. However, the settlement on this property never occurred and the proceeds action ended in a forfeiture order by consent concerning the assets in Kamay’s accounts and other properties.

The investigation and prosecution

The Australian Federal Police and Australian Securities and Investments Commission launched a joint investigation on 21 February 2014. The investigation culminated on 9 May 2014, with both men arrested.

On 10 and 11 December 2014 Kamay and Hill appeared before Justice Hollingsworth in the Supreme Court of Victoria in Melbourne. Kamay pleaded guilty to seven charges, while Hill pleaded guilty to six charges.

Kamay was sentenced to seven years and three months imprisonment with a non-parole period of four and a half years. Hill was sentenced to three years and three months with a non-parole period of two years.

Australian Statistician, David W. Kalisch acknowledged the significant effect the event has had on the ABS. He said, ‘The ABS commends the collaborative work undertaken by the CDPP, ASIC and the AFP fraud and anti-corruption team on the diligence and professionalism they brought to this investigation. It is reassuring that they have the will and the capacity to detect, investigate, and prosecute those involved in such a major betrayal of trust.‘

‘The incident was the first time in the ABS’ 100 year history that a staff member had been arrested for leaking statistics. We subsequently commissioned a thorough review of our security controls and strict embargo procedure with recommendations implemented to ensure we were doing all we could to avoid the possibility of recurrence. The ABS has shared these learnings with a number of APS agencies as we work together to deal with these complex matters and we continue to foster a strict security culture.’

In sentencing Kamay, Justice Hollingworth said ‘The gross profit you made is, by a very considerable margin, the largest insider trading profit to come before an Australian court. Apart from your early plea of guilty, Mr Kamay, and some very minor allowance for your age and immaturity, there is relatively little that can be said by way of mitigation. The CDPP was right to describe your conduct as the worst instance of insider trading to have come before the courts in this country’.

The Commonwealth Director of Public Prosecutions, Robert Bromwich SC, who appeared for the Crown at the sentencing hearing, said offences that undermine the integrity of the market are serious crimes warranting substantial gaol sentences.

‘This was deliberate and planned, and all underpinned by personal greed at every stage. The sentence imposed will encourage and support the people who do the right thing, as well as discouraging those who might be tempted to do the wrong thing,’ said Mr Bromwich.

Lukas Kamay has appealed against the severity of his sentence. The appeal is yet to be finalised.

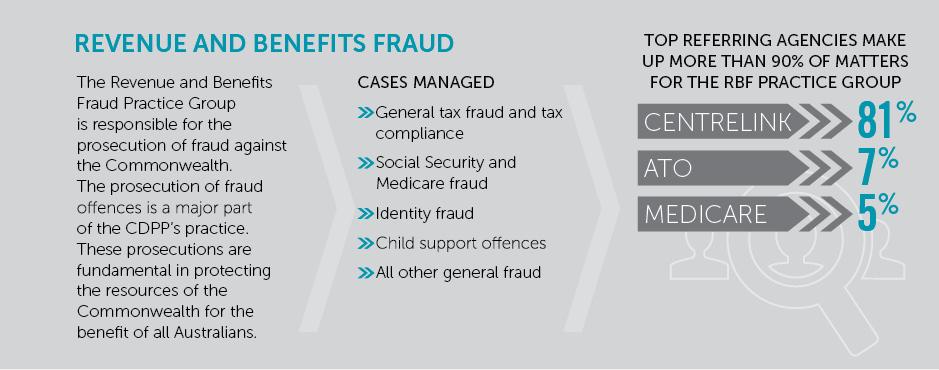

Revenue and Benefits Fraud

The Revenue and Benefits Fraud Practice Group Leader is James Carter, Deputy Director.

This practice group is generally responsible for prosecuting fraud against the Australian government, including general tax fraud, social security fraud, Medicare fraud, and identity fraud. The Revenue and Benefits Fraud Practice Group is also responsible for prosecuting fraud-related money laundering, counterfeit currency and child support offences.

Prosecuting fraud offences is a major part of the CDPP’s overall practice. These prosecutions are fundamental in protecting the resources of the Commonwealth for the benefit of all Australians.

Fraud prosecutions are diverse—fraud can be committed in numerous ways and span the broad range of Commonwealth programmes and assistance available to the Australian community, as well as the Australian taxation system. Frauds can range from making false statements to sophisticated and highly structured offending designed to evade tax obligations.

Commonwealth revenue and benefit systems rely heavily on the integrity and honesty of all Australians. Government agencies increasingly interact with customers through online services. Innovations have enabled customers to claim benefits and provide information through technology, such as voice recognition systems, mobile apps and electronic facilities. As a consequence, a large proportion of revenue and benefits fraud is now committed online. This has changed the evidence involved in prosecuting fraud offences, as there is now considerably less reliance on paper records. Evidence of electronic systems and their operation form an important part of briefs of evidence.

General deterrence is particularly important when considering the prosecution of revenue and benefits fraud and is fundamental in protecting these systems and public resources.

Prosecutions may involve significant sums of money, particularly where there has been a continuing fraud over many years or use of multiple identities or benefits. Prosecutions can be complex and demanding, and involve technical evidence from our partner agencies about the operation of their electronic systems to support and explain the evidence necessary to prosecute. We work closely with our partner agencies to seek to achieve best practice in investigating and prosecuting in this important area.

The Revenue and Benefits Fraud Practice Group has a strong strategic focus on active prosecution at all stages—through early engagement, assessment and the conduct of matters through court.

Revenue fraud

Prosecuting tax frauds continued to be a significant part of our practice this year. As in previous years, there were a significant number of fraud cases relating to income tax and the goods and services tax (GST). We prosecute tax frauds referred by the Serious Non-Compliance area of the Australian Taxation Office as well as the Australian Federal Police.

The GST is a key element of the Australian tax system. Prosecutions relating to GST vary in sophistication from small-scale fraud to large, complex schemes. By prosecuting people who exploit that system—for example, by failing to report cash income they receive or by falsifying claims for GST credits—we help to maintain acceptable levels of voluntary compliance with tax laws.

Benefits fraud

The Department of Human Services provides a range of health, social and welfare payments and services including through Centrelink, Medicare and Child Support. Of all our partner agencies, this department refers the largest number of briefs to the CDPP.

Our prosecutions play an essential role in protecting Commonwealth resources and ensuring support is provided where it is most needed in our community. Briefs typically relate to allegations that people have intentionally engaged in conduct and, as a result, received social, health or welfare services or payments they knew they were not entitled to.

Centrelink prosecutions typically involve a person receiving benefits that have been calculated on a false premise. For example, a person might say they are unemployed when, in fact, they are receiving income from paid employment or they might fail to advise the department that they have become a member of a couple. Cases can also involve fraud where someone has received benefits on behalf of a person who has died, or where someone uses multiple identities to obtain multiple benefits.

Child Support fraud includes claims for child support by someone who is not entitled to that support, parents who do not correctly declare their income or relationship status, and employers who fail to deduct an amount from a paying parent’s salary or wage or fail to forward an amount that has been deducted.

Medicare fraud may involve claims for services that were not provided. This can involve a person using their own name to claim services from, or service providers or their employees using patients’ identities to make fraudulent claims. We have established a national Medicare Focus Group to consider the specific issues raised by this practice area, in addition to our Focus Groups for Centrelink and Taxation matters.

Practice Group structure

The Revenue and Benefits Fraud Practice Group comprises three branches, one in Sydney, one in Brisbane and a third that operates across our Townsville, Cairns and Darwin offices. Revenue and benefits fraud cases are, however, conducted across all our offices around Australia, and each office strongly contributes to the Revenue and Benefits Fraud Practice Group.

Partner agencies

Over the past year our Revenue and Benefits Fraud Practice Group has engaged with agencies to advance their enforcement strategies and consider longer-term strategic issues. We have strengthened liaison and coordination arrangements with partner agencies and increased informal liaison.

This is the lead practice group for all liaison with the Australian Taxation Office and the Department of Human Services, also working closely with the Australian Federal Police.

In addition, this practice group liaises with and conducts prosecutions referred by:

- the Department of Social Services, which is responsible for programmes relating to families and children, housing support, disability and carers, employment services, childcare and senior citizens and government grants for specific purposes

- the Department of the Prime Minister and Cabinet, which has primary responsibility for Indigenous affairs and most Commonwealth Indigenous-specific policy and programmes

- the Department of Veterans’ Affairs, which refers briefs of evidence relating to a range of fraudulent activity, including claiming benefits to which one is not entitled, fraud through over-servicing by service providers, and deceased beneficiary cases.

This year the Revenue and Benefits Fraud Practice Group also established new liaison relationships with the Australian Federal Police Fraud and Anti-Corruption Centre and the National Disability Insurance Agency.

The Revenue and Benefits Fraud Practice Group is responsible for prosecuting fraud against the Australian Government. Crimes include general tax fraud, social security fraud, Medicare fraud, and identify fraud.

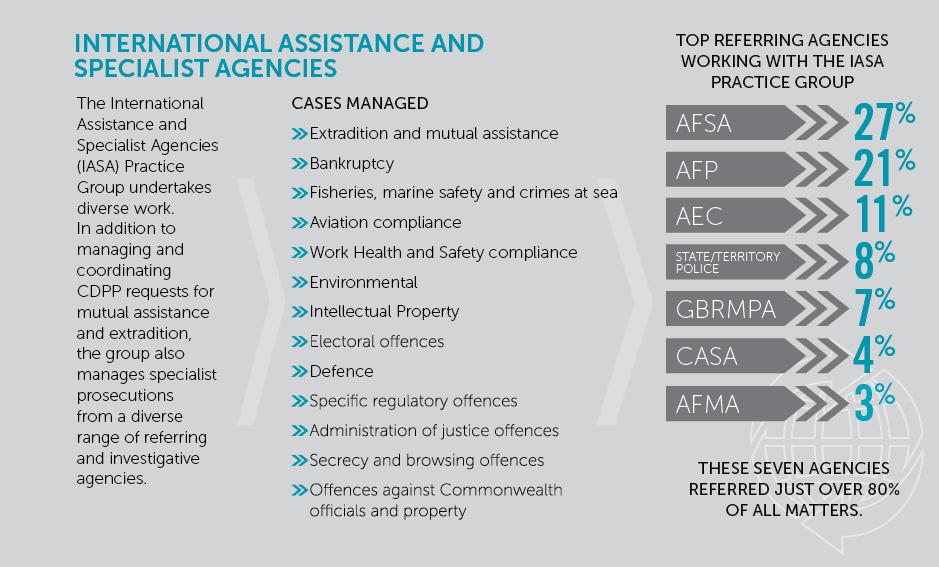

International Assistance and Specialist Agencies

The International Assistance and Specialist Agencies Practice Group Leader is Graeme Davidson, Deputy Director.

This practice group deals with offences against a wide array of Commonwealth laws, with specific responsibility for engaging with specialist Commonwealth agencies and international assistance.

International assistance (including mutual assistance and extradition)

International assistance is an important tool in the successful prosecution of transnational crime. Serious offences such as terrorism, people smuggling, drug trafficking, human trafficking and slavery type offences, bribery of foreign officials, money laundering and offences relating to child exploitation and abuse material, often have an international aspect and require international assistance for effective investigation and prosecution.

We seek cooperation from other countries to assist in the prosecution of transnational crime and to apprehend and extradite fugitives. While the Attorney-General’s Department has primary responsibility for these areas as Australia’s central authority for extradition and mutual assistance in criminal matters, we play an important role in assisting with requests.

Based on our expertise and practical experience in prosecuting, we also contribute to legal capacity programmes to strengthen effective investigation and prosecution of criminal activities such as people smuggling, human trafficking and terrorism. This contribution can be important in building international and regional links in the context of the increasingly transnational nature of criminal activity.

Mutual assistance

Mutual assistance is a formal process used by countries to assist each other to investigate and prosecute criminal offences and recover the proceeds of crime.

The formal mutual assistance regime runs parallel with the less formal system of international cooperation between investigating agencies, known as ‘agency-to-agency’ assistance. Formal mutual assistance channels are used when the request for assistance involves the use of coercive powers or when the material requested needs to be in a form that is admissible in criminal proceedings.

The mutual assistance regime rests on a network of international relations and obligations together with the willingness of participating countries to provide assistance to each other. This international network is underpinned by a number of bilateral treaties and multilateral conventions.

Australia has ratified 29 bilateral mutual assistance treaties and a number of multilateral conventions, which bind the signatories to provide mutual assistance to each other. These include the:

- United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances

- United Nations Convention against Transnational Organised Crime

- Convention on Laundering, Search, Seizure and Confiscation of the Proceeds of Crime.