Annual Report 2018 – 2019

Download a full PDF version of the 2018-19 CDPP Annual Report.

Contents

- Letter of transmittal

- About the CDPP

- Director’s foreword

- Chapter 1: Overview

- Chapter 2: How we operate

- Chapter 3: Our National Practice

- Chapter 4: Performance and reporting

- Chapter 5: Governance, audit and accountability

- Chapter 6: Corporate services

- Chapter 7: Financial services

- Chapter 8: Financial statements

- Appendices

The Office of the Commonwealth Director of Public Prosecutions (CDPP)

is an independent prosecution service established by Parliament to prosecute offences against Commonwealth law.

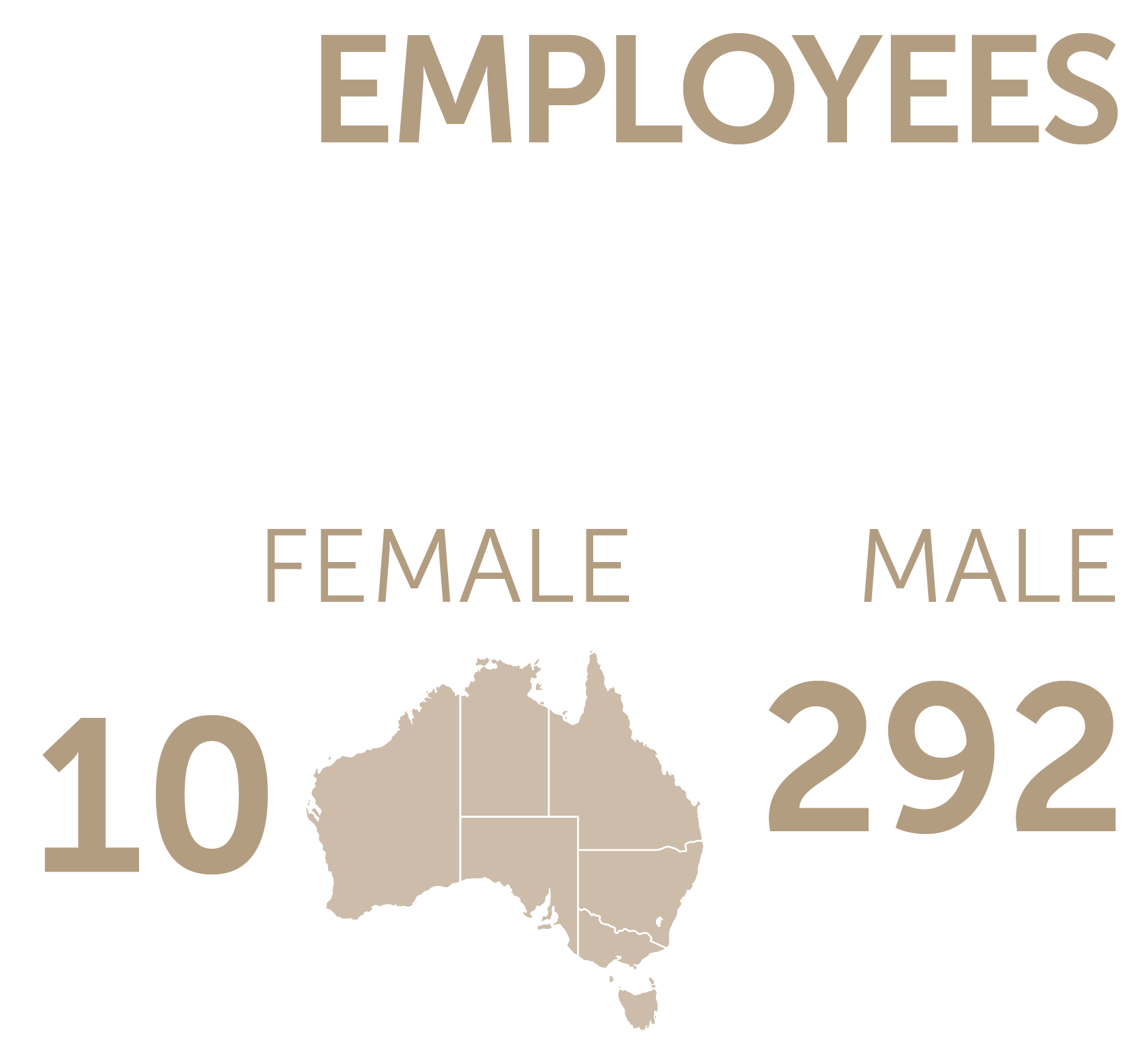

We are a Commonwealth statutory agency with 10 offices around Australia. The CDPP operates as an independent agency within the Attorney-General’s portfolio.

SERVICE

Australia’s independent prosecution service

ADVISE

Providing advice to assist the investigative process

SOCIETY

Contributing to a fair, safe and just society

PROSECUTE

Bringing cases to a close through effective prosecutions

JUSTICE

Prosecuting crimes against the Commonwealth for 35 years

EDUCATE

Highlighting outcomes to educate the community and deter offenders

Our aim

Our purpose

Our outcome

Strategic themes

The CDPP’s strategic framework is based on three themes:

SERVICE

To provide an efficient and effective prosecution service.

PARTNERS

To effectively engage with partner agencies and stakeholders.

PEOPLE

To invest in our people.

Our strategic themes focus and direct our effort. The matters we prosecute are diverse and complex, reflecting the evolving and expanding nature of offences against Commonwealth laws. Our strategic themes underpin how we set our priorities, providing a framework that enables us to achieve our purpose and deliver our stated outcome.

Our partners

We serve the public interest by maintaining strong and effective working relationships with partner agencies.

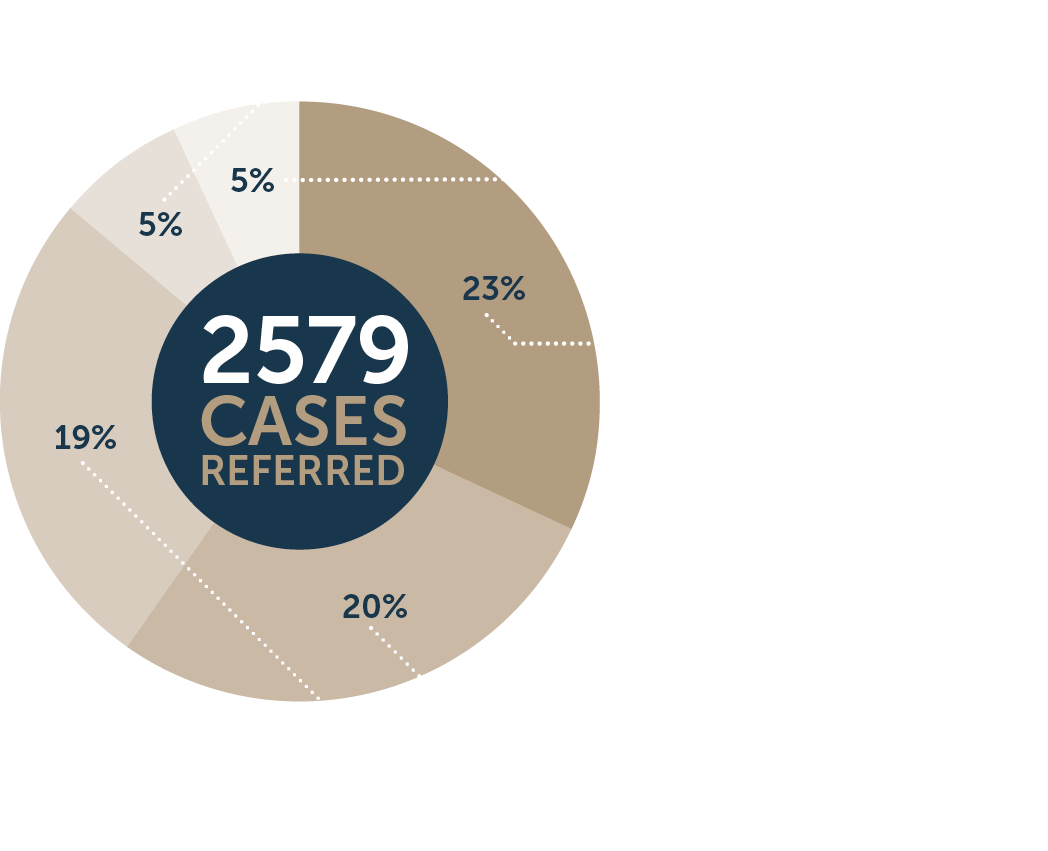

In 2018–19, 62 partner agencies referred cases to the CDPP:

- 46 Commonwealth investigative agencies

- 16 state and territory agencies.

PROSECUTIONS

- 3,961Matters before court

- 2,101Cases dealt with*

- 1,691Prosecutions resulting in a finding of guilt

- 890Prosecutions resulting in immediate imprisonment

APPEALS

- 15Prosecution appeals decided

- 8Successful appeals against the inadequacy of sentence

* This total is derived from the number of summary, trial and sentence phases closed during the reporting period.

Our practice

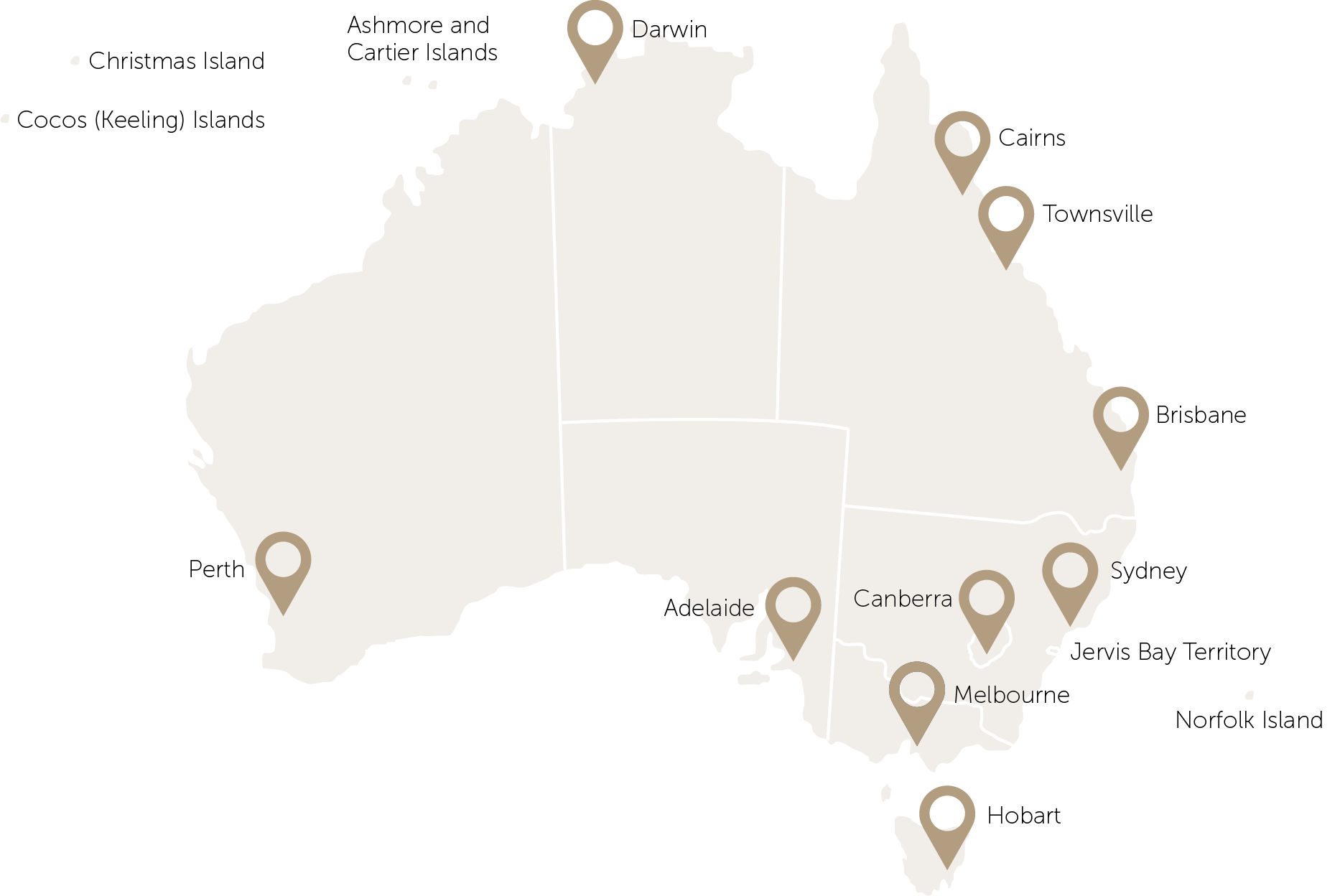

We have offices in Canberra, Sydney, Melbourne, Brisbane, Perth, Adelaide, Hobart, Darwin, Cairns and Townsville. We carry out legal work in the courts of every Australian state and territory.

We are also responsible for prosecuting offences in Jervis Bay and Australia’s external territories, including Norfolk Island, Christmas Island and the Cocos (Keeling) Islands.

International Engagement

For 35 years, the CDPP has been serving Australia through its contribution to a fair, safe and just society. Since we became an integral part of the Commonwealth justice system under the Director of Public Prosecutions Act 1983, the law enforcement landscape has changed markedly. We too have evolved, and have risen to the challenge of prosecuting an increasingly diverse and complex array of criminal offending.

At the heart of our practice is our people. We understand that in order to achieve our outcomes, successfully transition into a digitally-enabled practice, and support our stakeholders, we need to invest in and build the capabilities of our people. To this end, in 2018–19 we introduced a number of initiatives that, together, provide building blocks for the CDPP to improve prosecution practices and assist staff to enhance their professional capability and develop their skills as future leaders in their field.

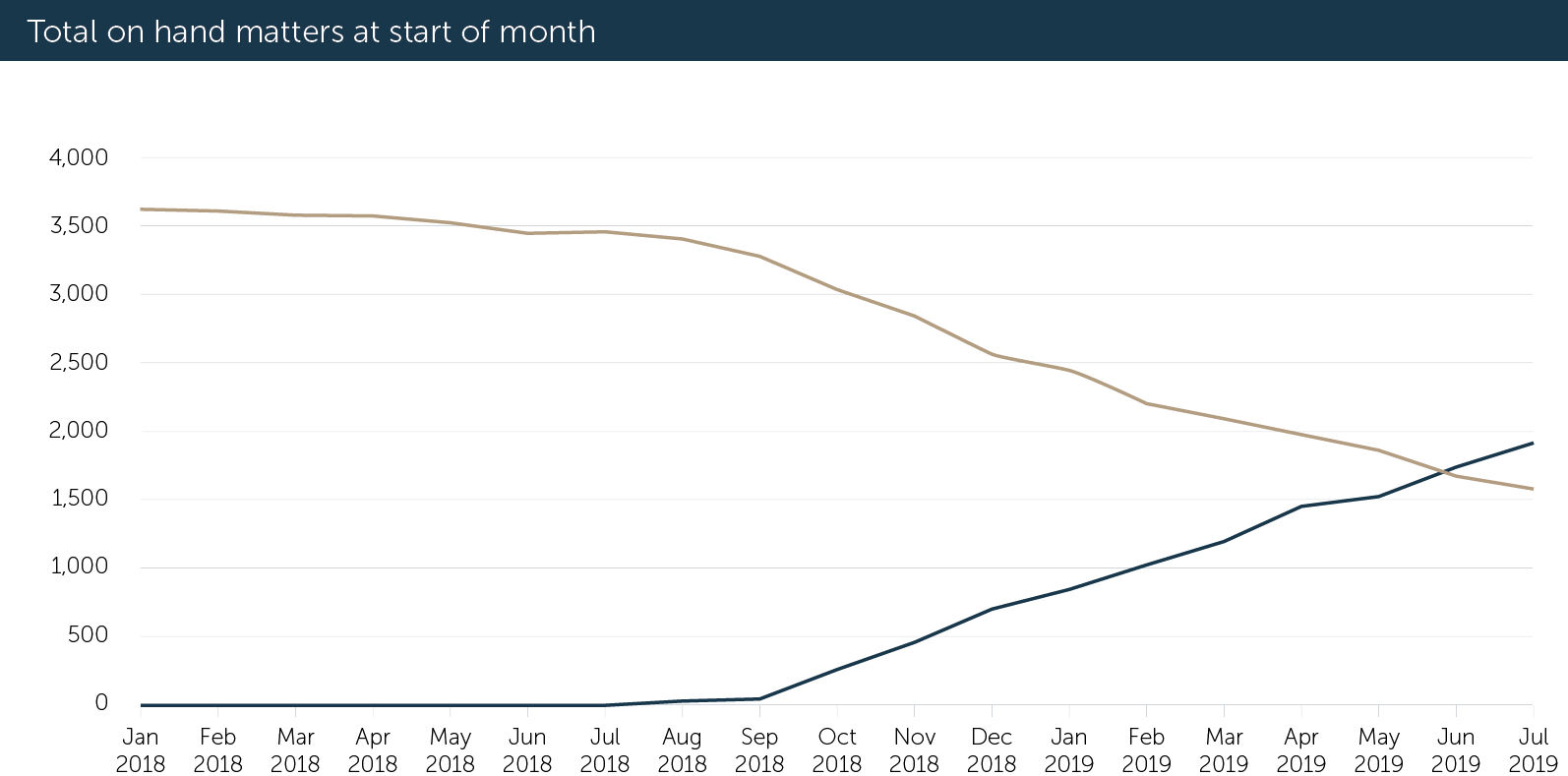

Launching caseHQ

We successfully introduced caseHQ in August 2018. The launch was the culmination of a significant period of research and development to provide a new business management system for the practice. caseHQ combines a suite of tools that deliver a secure, flexible and contemporary system, giving prosecutors end-to-end case management capability with embedded document and workflow management functions.

Providing us with the capability to more effectively track and measure our work is a key feature of caseHQ. It will allow us to more accurately allocate our resources, identify emerging themes and trends, and measure our performance against a range of criteria. This, in turn, enhances our ability to identify how we can provide the training, resources and materials our people need to ensure we continue to meet our outcomes.

Despite its ambitious scope, caseHQ was delivered on budget and within 11 months of selecting a vendor. In June 2019, we reached a significant milestone with more than half of all cases on hand being managed in caseHQ.

New ways of working

While the introduction of caseHQ is an important element of the CDPP’s digital transformation, we are also promoting a number of other technologies to support our people and practice into the future. In 2018–19, the CDPP introduced a range of initiatives that help staff achieve balance in their working lives and succeed in their professional endeavours.

On the technology front, our ICT systems have been upgraded so our staff can work remotely and flexibly. As of 30 June 2019, 33 employees had adopted formal remote working arrangements, while 54 staff had established part-time agreements, with a total of 231 of our staff remotely accessing their desktop. I anticipate we will continue to report growth in the number of successful flexible arrangements we have in place, enhancing our dynamic and productive work environment.

Underpinning our ability to encourage and adopt flexible practices is a strong understanding of our workplace needs, both immediately and into the future. In 2018, we established the CDPP’s Workforce Planning Committee to more effectively synthesise how we oversee and steer workforce planning decisions. The Committee uses a range of information, including data from caseHQ, to identify and address resourcing requirements.

As a result, we are better able to meet the challenges associated with emerging trends across our prosecution environment. This, in turn, enables us to balance staffing arrangements in relation to labour hire, ensuring we achieve greater levels of stability within the workforce.

Another key development during 2018–19 was the introduction of Digital Litigation Specialists within our practice. This team is leading our efforts to build capability across the CDPP, especially in relation to how we can best manage our large, complex and long-running cases.

Engaging with stakeholders

We could not successfully prosecute matters without close and ongoing relationships with the agencies responsible for identifying and investigating crimes against the Commonwealth. We engage with investigators regularly, providing advice and support throughout the prosecution process. We also participate and contribute to various criminal justice taskforces to support law enforcement outcomes.

To ensure the preparation of briefs of evidence and the progression of matters through court is as efficient and effective as possible, we provide our law enforcement partners with access to a range of tools, such as the Partner Agency Portal. This digital resource provides secure access to key documentation and support for investigators. It also links to the Digital Referrals Gateway, which supports our transition to receiving all briefs electronically. In April 2019, we launched the Comcare Engagement Framework, which supports our engagement with Comcare and provides investigators with information about prosecutions in this area.

Another key aspect of our stakeholder engagement is with external counsel. Our ability to bring in specialist practitioners to assist us with prosecutions and provide advice on more complex matters is vital to ensuring we achieve our outcomes. In 2018–19, we introduced the Counsel e-Newsletter initiative to enhance links with the counsel we brief.

In February 2019, the Attorney-General, the Hon Christian Porter MP, launched a new online resource for victims and witnesses. The site was developed in consultation with victims, witnesses, non-government organisations and CDPP prosecutors, in response to recommendations from the Royal Commission into Institutional Responses to Child Sexual Abuse. This resource is improving our ability to meet the needs of our most vulnerable stakeholders, who often require additional support in navigating the justice system.

Performing against our purpose

Our commitment to effectively prosecuting matters remains unwavering. It is driven by the expectations of the Australian public and our determination to achieve outcomes in the public interest. In 2018–19, we continued to measure our performance against three key measures:

- meeting the test for prosecution in the Prosecution Policy of the Commonwealth

- partner agency satisfaction

- prosecutions resulting in a conviction.

The launch of caseHQ has been instrumental in helping us to audit compliance in relation to addressing the terms of the tests for prosecution. This is done through Prosecution Policy Declarations, which are automatically generated within caseHQ. It is not possible to finalise key legal decision-making tasks without completing a declaration, and we continue to achieve a 100 per cent compliance rate in this area.

Our key measure for partner agency satisfaction is a biennial survey that has an established methodology and baseline to track satisfaction on an ongoing basis. Comparing the past two surveys from 2016 and 2018 shows our satisfaction rate is improving, reaching 87 per cent in 2018. While this fell slightly short of our 90 per cent target, we continue to build on the survey’s feedback to improve and enhance our relationships with our partners. The next survey will be held in the first half of 2020.

Our conviction rate of 97 per cent is a testament to the commitment and hard work of our prosecutors and partner agencies. In 2019–20, we will be expanding how we measure compliance in this area to differentiate between findings of guilt in all of our concluded cases, and findings of guilt for defended matters only.

We understand that ensuring timely assessment of briefs is vitally important to partner agencies. Over the last two years we have set ourselves a target of assessing 85 per cent of briefs within 90 days of receipt1 and we have continued to meet this key performance indicator since it was put in place.

Emerging trends

Our digital transformation, the skills and training we provide to our people, and the strong relationships we build with our stakeholders are all part of our commitment to providing an independent and effective prosecution service now and into the future.

We deal with diverse matters that reflect the evolving and expanding nature of offences against Commonwealth law. Our national practice model reflects our ability to prosecute matters from terrorism to money laundering, child exploitation to welfare fraud, and regulatory non-compliance to illicit drug importations.

Across all crime types, we are seeing an increasing level of complexity. This can be attributed to the inclusion of international elements to the offending, large volumes of digital evidence, multiple defendants, or a combination of these and other factors. To address these challenges effectively, we need to be agile and responsive in how we prepare and develop our briefs.

During 2018–19, we responded to recommendations from a number of royal commissions that have implications for our practice, including the Royal Commission into Institutional Responses to Child Sexual Abuse, the Victorian Royal Commission into the Management of Police Informants and the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Looking ahead

In response to the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, the Australian Government provided an additional $41.6 million in funding to the CDPP over four years. We are developing key resources, recruiting new staff, and identifying counsel with criminal and corporate law experience to assist with an anticipated increase in caseload.

The Australian National Audit Office is conducting a performance audit of the CDPP, examining the efficiency with which we manage our cases. Specifically, the audit is exploring whether we have efficient arrangements in place for the assessment of cases, and whether we effectively monitor and report on our case management. The findings of the audit are expected to be finalised during 2019–20, and will form part of our ongoing efforts to ensure we consistently deliver an effective and independent prosecution service.

We will continue on our journey of digital transformation, and over the next 12 months will embed our new processes and systems, while strengthening our capability in the digital operating environment. Our Corporate Plan provides more details about how we intend to leverage the gains we made during 2018–19 over the next four years. Our ambitious program to build a digitally capable, flexible and agile workforce provides the foundation for our digital transformation, and continued success as Australia’s federal prosecution service.

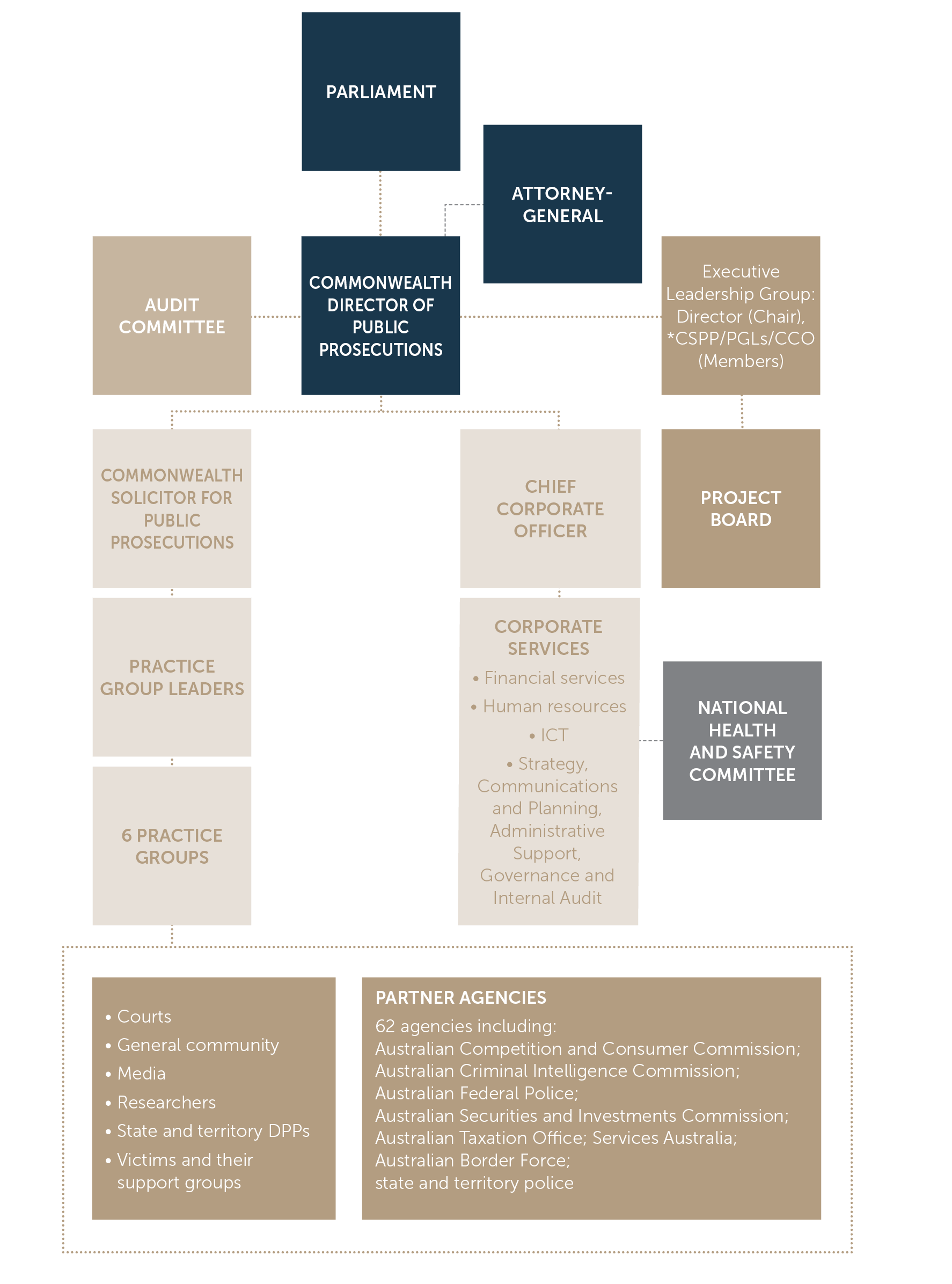

Australia’s independent prosecution service

The CDPP was established under the Director of Public Prosecutions Act 1983 (DPP Act) and started operating on 5 March 1984. The DPP Act sets out the functions and powers of the Director, including independent responsibility for carrying out prosecutions for offences against Commonwealth laws. The Commonwealth Solicitor for Public Prosecutions takes a lead role in supporting the Director to fulfil our statutory obligations, while the Executive Leadership Group oversees legal and corporate functions.

While the CDPP is part of the Commonwealth Attorney-General’s portfolio, we operate independently of both the Attorney-General and the political process. However, under section 8 of the DPP Act, the Commonwealth Attorney-General has the power to issue directions or guidelines to the Director. Before issuing directions, the Attorney-General must consult with the Director, and any directions or guidelines must be in writing and tabled in Parliament. The CDPP is bound by any directions or guidelines issued by the Attorney-General. Since the CDPP was established, seven directions have been issued. No directions were issued during the reporting period.

The CDPP is an integral part of the Australian justice system and is committed to upholding the highest professional and ethical standards. We liaise with state and territory prosecuting authorities, and attend valuable national prosecution forums, including the Conference of Australian Directors of Public Prosecutions and the National Executive Officers’ Meeting. We work collaboratively with stakeholders at every level of the justice system, contributing to legislative reform and procedural forums to improve the delivery of our prosecution service, and meet the expectations of the broader community.

Our national reach allows us to work efficiently and effectively with partner agencies and state and territory counterparts, to progress our prosecution work and strengthen our working relationships with all stakeholders in the justice system.

We also work to ensure that victims, witnesses, alleged offenders and others affected by the criminal justice process are treated fairly.

The CDPP is committed to promoting and maintaining an organisational culture that values fairness, equity and respect. All staff sign our guideline on official conduct, and are expected to maintain the high ethical standards that are valued across our organisation.

We provide advice to referring agencies, stakeholders and international counterparts about cases, law reform and the application and operation of Commonwealth law.

We contribute to a fair, safe and just society by successfully prosecuting crimes against Commonwealth law.

We treat victims and witnesses with respect and support the most vulnerable through the prosecution process.

We educate the community about the consequences of breaking the law, which sends a strong message of deterrence.

Case study Prosecuting cases in unusual places

When your flight lands at an international airport runway that is part of the local golf course, you know your visit is going to be unusual. This is the gateway for CDPP prosecutors arriving at the Cocos (Keeling) Islands (CKI) at what is thought to be the only golf club in Australia, perhaps in the world, to have an international runway.

Closer to Indonesia than Australia, the CKI lie in the Indian Ocean some 2,750 kilometres northwest of Perth. Every three months, CDPP prosecutors from our Perth office spend a week there, and another week on Christmas Island 900 kilometres away, to prosecute cases. The prosecutions they conduct include offences against Western Australian law as well as Commonwealth laws.

Both islands are generally law abiding, if somewhat unusual, places. The 450 strong population of the CKI has few cars. So it is unsurprising that some of the driving offences prosecuted by the CDPP involve golf carts, as these vehicles are commonly used to get around. However, regardless of what you drive, it is illegal to lock your vehicle in case it needs to be moved. In another sign of the population’s honesty, the thatched bungalows allocated to visitors don’t have keys.

On both the CKI and Christmas Island, the types of offending mean courts usually dispense fines and community orders. Everyone knows each other, so perpetrators are often very apologetic to their victims, and the courtroom is usually full of spectators. The courts provide a social focus for the week, and family and friends turn up to support both victims

and defendants.

From Perth, there are only one or two flights to the islands each week. This means the CDPP prosecutor, the defence lawyer, the Legal Aid officer and the magistrate all fly out together. It is usually the same Legal Aid officer on each circuit.

CDPP prosecutor Jordan Johnston, who has travelled to Christmas Island a number of times, said continuity is important in legal representation on the islands.

‘The Legal Aid officer works closely with the small community on Christmas Island and has a good feel for the plea in mitigation in each case,’ he said.

‘They make submissions on what an appropriate sentence should be, given all the circumstances and what community orders have worked in the past.’

Another CDPP prosecutor, Oralee Logan, who travels from the Perth office to the CKI, believes there is a significant benefit for all the parties in being able to liaise informally outside the courtroom.

‘As the defendant often pleads guilty, it means the different sides can discuss issues ahead of time and be efficient in the courtroom,’ she said.

Given there are no telecommunication or internet services on the CKI, the ability to work effectively in the courtroom is important. Prosecutors have no way to contact the office if they need to access resources if a matter is contested at the last minute.

Mr Johnston said that despite prosecuting ‘fairly routine state offences’ such as road traffic misdemeanours, prosecutors need to understand and apply Western Australian state law, which makes the work more interesting.

‘It’s a unique experience working within the criminal justice system in a small community,’ he said.

Along with the CKI and Christmas Island, the CDPP is also responsible for prosecuting matters in Jervis Bay, Norfolk Island and Antarctica.

A responsive national legal practice

Our national legal practice group operating model provides an efficient, effective and nationally-consistent federal prosecution service.

The model helps to harness staff expertise to improve the timeliness and effectiveness of prosecutions.

Leveraging the national practice group model means we are able to allocate specialist prosecutors to matters depending on areas of priority and need.

Prosecuting Commonwealth offences

We work in an increasingly dynamic environment prosecuting a diverse range of complex crimes, which are often transnational in nature and regularly involve large quantities of electronic evidence.

Our caseload of complex matters continues to expand and evolve. It includes: criminal cartels, foreign bribery, online child exploitation, sophisticated revenue and benefits fraud, complex tax fraud, fraud by company directors and breaches of directors’ duties, large-scale and cross-border organised crime activity including drug offences, human trafficking, slavery and terrorism offences.

We anticipate the profile of our work will continue to change as emerging crime types, such as foreign interference, espionage and cybercrime, shape our prosecutions in the future. To ensure we are able to meet these challenges, the CDPP actively participates in the legislative reform process.

Prosecution services for partner agencies

We continue to refine and improve our prosecution services for partner agencies. These services cover every aspect of the criminal prosecution process, from pre-brief advice and brief assessment to litigation services during the court process, creation of specialist resources for agencies, and liaison activity.

We also collaborate extensively with our partners to build capability and drive improvements in the prosecution process. This collaboration ranges from tailored training and secondments or outpostings, to participation in joint initiatives, such as government taskforces.

The growing need to digitise prosecution processes has seen us work closely with our partners to design standards for the submission of electronic briefs. As a result of this work, approximately 40 per cent of all briefs are now submitted to the CDPP in electronic form. For those matters that are referred prior to charges being laid, the figure is around 85 per cent. In 2018–19, we received a substantial number of these e-briefs through our Digital Referrals Gateway from a range of agencies.

Each of our legal practice groups actively engages with partner agencies to establish and build strong working relationships. The insights our prosecutors develop help to ensure we provide effective prosecution services that are responsive to the operating environment and our partner agencies’ needs.

Connecting with state and territory prosecution services

As the CDPP prosecutes offences in all Australian jurisdictions, we have established procedures with each state and territory prosecution service for trials that involve both Commonwealth and state or territory offences.

We can prosecute indictable offences against state or territory laws where our Director and other senior CDPP legal staff hold an authority to do so under the relevant jurisdiction’s laws. In addition, our legal staff can conduct committal proceedings and summary prosecutions on behalf of the Director for offences against state or territory law where a Commonwealth officer is the informant.

Prosecution Policy of the Commonwealth

The Prosecution Policy of the Commonwealth applies to all Commonwealth prosecutions. It outlines the principles, factors and considerations our prosecutors must take into account in prosecuting offences against the laws of the Commonwealth.

The policy promotes consistency, fairness and efficiency. It guides decision-making throughout the prosecution process for every matter, regardless of the crime type or practice group.

Criteria governing the decision to prosecute—the prosecution test

The CDPP must apply the test for prosecution, as set out under the Prosecution Policy of the Commonwealth, when making a decision to prosecute. The test requires prosecutors to be satisfied there is sufficient evidence to prosecute a case, and that the prosecution is in the public interest.

To determine if there is sufficient evidence to prosecute a case, we must be satisfied there is both prima facie evidence of the elements of the offence, and a reasonable prospect of obtaining a conviction. In making this decision, our prosecutors must evaluate how strong the case is likely to be when presented in court. They must take into account matters such as the availability, competence and credibility of witnesses, their likely effect on the arbiter of fact (magistrate or jury), and the admissibility of any alleged confession or other evidence. Our prosecutors also consider any lines of defence open to the alleged offender, and any other factors that could affect the likelihood of a conviction.

In addition, our prosecutors consider if any evidence might be excluded by a court. If that evidence is crucial to the case, this may substantially affect the decision whether or not to prosecute. Our prosecutors need to look closely at the evidence in each matter, particularly in borderline cases.

Once satisfied there is sufficient evidence to justify starting or continuing with a prosecution, our prosecutors then consider whether pursuing a prosecution is in the public interest. This involves assessing all provable facts and surrounding circumstances.

Public interest factors we may consider include:

- Whether the offence is serious or trivial

- Mitigating or aggravating circumstances

- The age, intelligence, physical health, mental health or vulnerability of the alleged offender, witness or victim

- The alleged offender’s criminal history and background

- The passage of time since the alleged offence

- The availability and efficacy of any alternatives to prosecution

- The prevalence of the alleged offence and the need for general and personal deterrence

- The attitude of the victim or victims

- The need to apply regulatory or punitive imperatives

- The likely outcome in the event of a finding of guilt.

The decision to prosecute must be made impartially, and must not be influenced by reference to race, religion, sex, national origin or political association, activities or beliefs of the alleged offender, or of any other person involved. The decision to prosecute must not be influenced by any possible political advantage or disadvantage to the Government, or to any political group or party.

The Prosecution Policy of the Commonwealth is on our website.

Measuring compliance with the prosecution test

Our prosecutors are required to certify compliance in addressing the test for prosecution in the Prosecution Policy of the Commonwealth by completing a Prosecution Policy Declaration. Since introducing this performance metric, we have achieved 100 per cent compliance.

These declarations are entered electronically into our case recording and information management systems. This has been an important initiative to confirm and capture evidence that the Prosecution Policy of the Commonwealth has been addressed. Specifically, it provides assurance that our prosecutors have considered whether there is a prima facie case, whether there are reasonable prospects of a conviction, and whether a prosecution is in the public interest at each stage of the prosecution process.

Treating victims of crime with courtesy, dignity and respect

In February 2019, the Commonwealth Attorney-General, the Hon Christian Porter MP, launched our web-based service for victims and witnesses of crime. The website provides tailored and timely information, tools and resources to support victims, witnesses and carers through the prosecution process.

The site builds on our understanding that victims and witnesses play a critical role in the prosecution process, and our commitment to ensuring they are treated with respect. Our dedicated and valued Witness Assistance Service provides support to vulnerable victims and witnesses involved in matters we are prosecuting. To ensure we provide consistent and appropriate support, CDPP prosecutors are required to refer any matters where there are identifiable child victims, victims of slavery, servitude or forced marriage to the service.

Our Victims of Crime Policy guides and supports victims and witnesses through the prosecution process, and we have established effective processes and procedures linked to the Prosecution Policy of the Commonwealth. In all prosecutions, we treat victims with courtesy, compassion, cultural sensitivity and respect for their dignity and entitlements.

Educating the community about our role

To educate the community about our role and build confidence in the federal justice system we:

- Promote prosecution outcomes on our website www.cdpp.gov.au

- Highlight the positive working relationships we have with partner agencies and state and territory counterparts

- Regularly participate in court users forums and committees

- Attend relevant legal conferences and events

- Provide input into legislative reform.

Promoting prosecution outcomes educates the community about the consequences of committing crimes against Commonwealth law, and also deters potential offenders.

Our organisation

Our organisation is made up of specialist legal practice groups supported by our corporate services group. Together, they form our national practice group model, which is designed to provide a unified and nationally consistent federal prosecution service.

The model allows us to respond to the changing nature and complexity of criminal activity. Our staff are agile, flexible and able to work across practice groups in response to agency referrals or other operational needs.

We are continuing to optimise the model to ensure it continues to evolve and deliver benefits, including improvements to our brief assessment timeframes,

the early resolution of matters, timely pre-brief advice and effective investigative and prosecution outcomes.

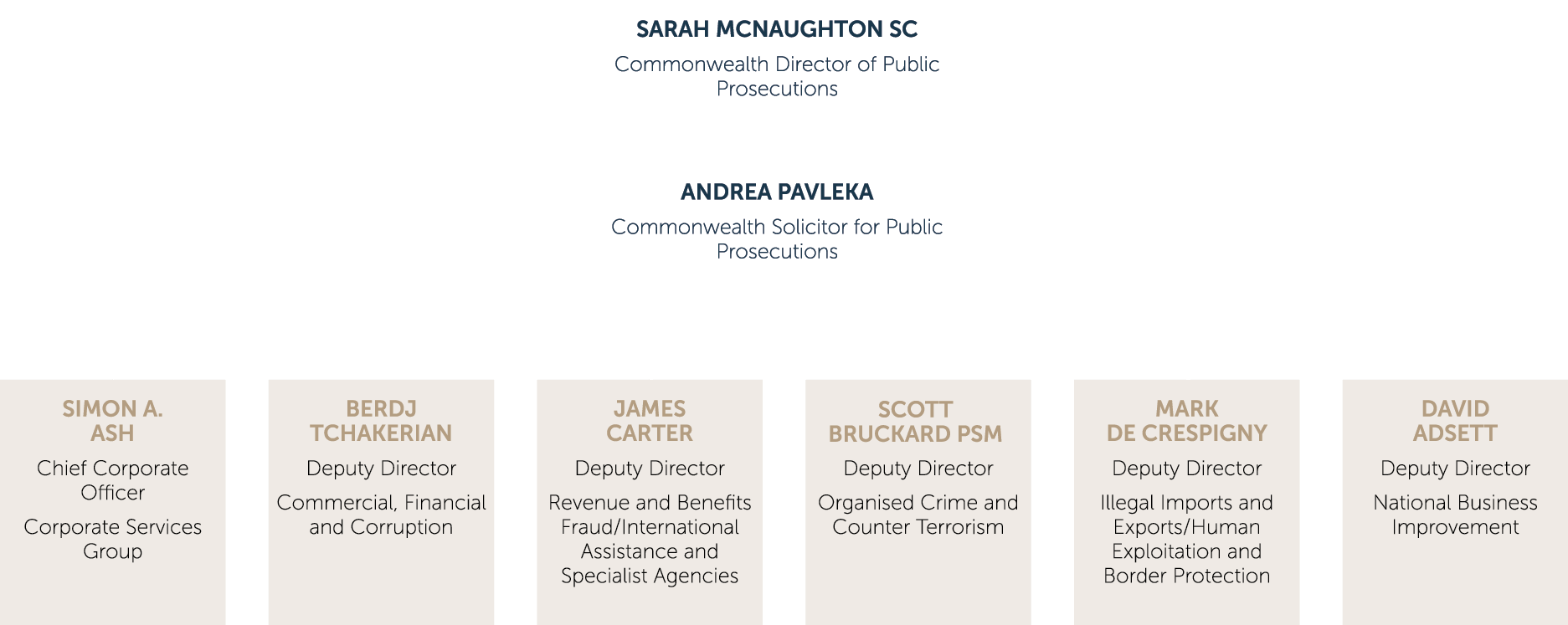

Figure 1: Organisational chart as at 30 June 2019

The role of the Director

Our legislative and policy framework establishes the role of our organisation and the statutory position of Director.

Key elements include:

- Director of Public Prosecutions Act 1983 (DPP Act)

- Public Governance, Performance and Accountability Act 2013 (PGPA Act)

- Public Service Act 1999

- Prosecution Policy of the Commonwealth.

The DPP Act established the Office of the Director of Public Prosecutions. It sets out the functions and powers of the Director, including independent responsibility for carrying out prosecutions for offences against Commonwealth law.

The Director delegates or authorises most of these functions or powers to be carried out by CDPP staff. Together, the Director and staff constitute a statutory agency, led by the Director.

The Director also has a number of miscellaneous functions, including to:

- provide legal advice to Commonwealth investigators

- apply for superannuation forfeiture orders under Commonwealth law.

The role of the Commonwealth Solicitor for Public Prosecutions

The Commonwealth Solicitor for Public Prosecutions takes a lead role in supporting the Director to fulfil her statutory obligations.

The Commonwealth Solicitor for Public Prosecutions works with our legal practice groups and corporate services group to make sure we have the essential systems, processes, people and culture in place to fulfil our purpose and deliver outcomes.

The Commonwealth Solicitor for Public Prosecutions is committed to ensuring the CDPP is a contemporary and innovative legal practice that operates in a nationally consistent manner. The Commonwealth Solicitor for Public Prosecutions focuses on:

- ensuring CDPP staff have access to key legal resources and harness their combined knowledge and experiences in the most efficient way possible

- encouraging early and efficient preparation and management of cases, including appropriate digital solutions and engagement of counsel

- continuing to foster a team-based approach to the way we manage our matters

- continuing our deep engagement with partner agencies when it comes to liaison, pre-brief advice and court work

- continuing to improve our service to partner agencies, including in relation to timeliness

- developing a strong culture and agile workforce by embracing more flexible ways of doing our work

- developing staff via diverse work experiences (within and outside our organisation) and ensuring access to relevant and high-quality training and education.

The Commonwealth Solicitor for Public Prosecutions leads the Legal Business Improvement Group. Elevating this function to the Commonwealth Solicitor in 2017 reinforced the Director’s emphasis on transforming the CDPP, improving

day-to-day operations of the legal practice, and achieving national consistency.

The role of the Executive Leadership Group

The Executive Leadership Group (ELG) provides a broad range of strategic and specialist legal expertise in support of CDPP outcomes. Chaired by the Director, the group comprises the Commonwealth Solicitor for Public Prosecutions, the Deputy Directors who lead each of the CDPP’s specialist practice groups and our Chief Corporate Officer.

Our leaders

Commonwealth Director of Public Prosecutions, Sarah McNaughton SC

On 5 May 2016, the former Attorney-General, Senator the Hon George Brandis QC, announced the appointment of Ms Sarah McNaughton SC as Commonwealth Director of Public Prosecutions for five years.

Ms McNaughton has more than 30 years’ experience as a legal practitioner, having held a range of roles in private practice and with the CDPP. She has been a respected member of the New South Wales Bar since 1996 and was appointed Senior Counsel in 2011. With specialist expertise in offences related to taxation, corporate crime, drug importation and terrorism, Ms McNaughton has appeared as prosecution and defence counsel in complex criminal trials. She has degrees in Arts (Hons) and Law (Hons), and a Master of Laws from the University of Sydney.

Commonwealth Solicitor for Public Prosecutions, Andrea Pavleka

In February 2017, the Director appointed Ms Andrea Pavleka as the Commonwealth Solicitor for Public Prosecutions. Prior to her appointment, Ms Pavleka was Deputy Director of the Illegal Imports and Exports practice group, and the Human Exploitation and Border Protection practice group.

In her career as a criminal prosecutor, spanning 28 years, Ms Pavleka has managed a range of functions across the CDPP’s practice, including prosecutions related to drug importations, tax fraud, people smuggling, organised crime and counter terrorism. As a Federal Prosecutor, she managed major criminal litigation, including some of the CDPP’s most complex and long-running trials.

Ms Pavleka has been a member of the senior executive since 2004 and worked in both the Melbourne and Sydney offices of the CDPP. She holds a Law degree from the Australian National University.

Deputy Director National Business Improvement, David Adsett

As a Federal Prosecutor with more than 30 years’ experience, Mr Adsett has been responsible for successfully prosecuting a wide range of offence types. These include money laundering, tax fraud, commercial fraud, drug importation, people smuggling and terrorism.

He currently leads the CDPP’s National Business Improvement area, focusing

on developing the skills, and delivering

the tools and infrastructure required to drive our digital transformation.

Mr Adsett’s ongoing interest in innovation in the legal practice has led to a range of improvements that support our prosecutors, our investigative partners and our ability to measure performance.

Mr Adsett holds degrees in Law and Arts from the University of Queensland, and a Master of Laws degree from the University of Sydney. Mr Adsett is also a graduate of the Australian Institute of Company Directors.

Deputy Director Organised Crime and Counter Terrorism, Scott Bruckard PSM

Mr Bruckard joined the CDPP in 1987 and has been a member of the senior executive since 2014. He leads the Organised Crime and Counter Terrorism Practice Group, responsible for prosecutions related to terrorism, large-scale drug and tobacco importation, firearms trafficking, money laundering, war crimes and national security.

Mr Bruckard is committed to improving law enforcement outcomes and developing better ways to manage large criminal litigation, particularly through more effective partnerships and the application of new technology.

In June 2016, Mr Bruckard was awarded a Public Service Medal in recognition of his distinguished service to the law enforcement and justice community, particularly his role in leading significant counter terrorism prosecutions.

He holds degrees in Arts and Law from the University of Melbourne.

Deputy Director Revenue and Benefits Fraud, and International Assistance and Specialist Agencies, James Carter

Mr Carter has extensive experience in Commonwealth criminal law, having commenced his legal career at the CDPP in 1987. After prosecuting matters in the Australian Capital Territory and New South Wales, he worked in the areas of law reform and practice management. He then became the Deputy Director for Revenue and Benefits Fraud and in 2019 also assumed responsibility for International Assistance and Specialist Agencies.

Mr Carter has worked extensively with partner agencies across a wide range of criminal offences, prosecuting matters relating to tax, social security and identity fraud, helping to protect the integrity of Commonwealth programs. He has also contributed to the work of the Australian Law Reform Commission, particularly in relation to sentencing federal offenders and the development of Commonwealth criminal law.

Mr Carter has been a member of the senior executive of the CDPP since

2004 and a Deputy Director since 2007. He holds degrees in Law and Arts from the Australian National University, and is a graduate of the Australian Institute of Company Directors.

Deputy Director Illegal Imports and Exports, and Human Exploitation and Border Protection, Mark de Crespigny

Mr de Crespigny has national responsibility for prosecuting a large variety of crime types, including general drug, precursor and tobacco importation offences, money laundering, child exploitation offences, human trafficking, slavery and people smuggling.

He joined the CDPP in 1989 and has worked in our Sydney, Canberra and Adelaide offices. Mr de Crespigny’s experience in successfully prosecuting a range of crime types and managing relationships with key stakeholders underpins his ability to coordinate a broad and complex area of national practice.

As a member of the senior executive for more than 12 years, Mr de Crespigny became responsible for the Illegal Imports and Exports practice group and the Human Exploitation and Border Protection practice group in 2017.

Mr de Crespigny holds degrees in Law and Commerce from the Australian National University.

Deputy Director Commercial, Financial and Corruption, Berdj Tchakerian

Mr Tchakerian joined the CDPP in 1986 and has prosecuted a wide range of cases including fraud and drug matters. He was the CDPP’s representative on Project Wickenby, a whole-of-government taskforce focused on combatting tax fraud. In this role he worked closely with partner agencies over a number of years to contribute to the success of the taskforce, and maintains strong links in this area of law enforcement.

Mr Tchakerian became a member of the CDPP’s senior executive in 2000, and in 2017 he became responsible for the Commercial, Financial and Corruption practice group.

He holds degrees in Law and Arts from Monash University.

Chief Corporate Officer, Simon Ash

Mr Ash has had a long and accomplished career in the Australian Public Service. As a senior economic adviser to two Prime Ministers, he was instrumental in preparing Federal Budget and Financial Statements, and has been the Chief Financial Officer of five Commonwealth agencies.

Mr Ash has extensive experience in leading corporate services, introducing innovative information and communications technology solutions, automated purchasing and procurement systems, and assimilating all corporate functions following the merger of two departments.

He was a key participant in the Australian Government’s movement to accrual budgeting in 1999 and the introduction of the Financial Management and Accountability Act 1997. Mr Ash has also provided extensive strategic policy and budgeting advice to the Expenditure Review Committee of Cabinet.

He has been a member of the Senior Executive Service within the Australian Public Service for more than 20 years, and joined the CDPP in 2017.

He holds degrees in Commerce and Economics from the Australian National University.

National Practice Group model

Our current operating model has allowed prosecutors to specialise in a range of crime types, while having flexibility to explore work in different jurisdictions and practice groups when the opportunity or need arises.

The Prosecution Policy of the Commonwealth outlines the principles, factors and considerations our prosecutors must take into account when prosecuting offences against the laws of the Commonwealth. It provides the framework for decision-making for all our prosecutions, which means our prosecutors can move seamlessly between practice groups.

Commonwealth Director of

Public Prosecutions

Independent responsibility for conducting prosecutions against Commonwealth law

Commonwealth Solicitor for Public Prosecutions

Lead role in supporting the Director and overseeing the operations of the legal practice and improvements to the legal business via the Legal Business Improvement Group

Commercial, Financial and Corruption

Prosecutes serious financial crimes and corruption offences

International Assistance and Specialist Agencies

Prosecutes matters referred by specialist agencies and provides international assistance

Human Exploitation and Border Protection

Prosecutes child exploitation, people trafficking, people smuggling, migration offences and more

Illegal Imports and Exports

Prosecutes offences associated with protecting Australia’s borders, including drug offences

Organised Crime and Counter Terrorism

Prosecutes counter terrorism and large-scale organised crime offences

Revenue and Benefits Fraud

Prosecutes general tax, social security, Medicare and identity fraud

National Business Improvement

Fosters innovation and drives technology-related business improvements across the legal practice

Legal Business Improvement

Focuses on operational aspects of the business to enable, support and modernise our legal practice

Corporate Services Group

Enables and supports the activities of the legal practice through a range of services: Finance, Technology, People, Communications, Records, Library, Governance,

Risk and Audit

Structure of the practice groups

The legal practice groups conduct prosecutions on behalf of the Director.

Each practice group is led by a Deputy Director (Practice Group Leader) who is responsible for:

- prosecutions conducted by the practice group across Australia

- national liaison and prosecution services delivered by the practice group

- policy development for issues that concern the practice group

- the CDPP’s contribution to law reform related to the crime types prosecuted by the practice group.

The Legal Business Improvement Branch provides crucial support to the Commonwealth Solicitor for Public Prosecutions, while the National Business Improvement Group fosters innovation and drives technology-related business improvements.

Our legal practice groups are supported by our customer-focused and collaborative Corporate Services Group, led by our Chief Corporate Officer. This group provides essential services in support of the efficient operation of our busy legal practice.

Case study Financial Adviser Sentenced to 10 Years' Imprisonment

On 15 March 2019, former financial planner Gabriel Nakhl (39) was sentenced to 10 years’ imprisonment with a non-parole period of six years, after he used more than $5 million of his clients’ investment funds for his own purposes. The court made reparation orders totalling more than $4.5 million in favour of Mr Nakhl’s victims.

The court found that while Mr Nakhl was a representative of Australian Financial Services Limited, which was in liquidation, and the sole director of SydFA Pty Ltd, which was deregistered,

he advised clients to set up

self-managed superannuation funds and to invest their superannuation and other funds in products such as shares, managed funds and high interest rate bank accounts.

However, rather than investing his clients’ funds in these products, Mr Nakhl used them to pay some of his personal and business expenses, and to invest in shares and options his clients had not authorised. Mr Nakhl then lied to investors by providing them with regular reports that falsely stated he had invested their funds in accordance with his advice, and that their investments were performing well.

The 12 investors allowed

Mr Nakhl to invest approximately $6.7 million on their behalf. He lost approximately $5.1 million of the invested funds, and most of his clients lost all their life savings and superannuation.

In September 2013, Mr Nahkl became a bankrupt and placed SydFA Pty Ltd into liquidation. In November 2013, he was permanently prevented from providing financial services. He pleaded guilty to eight counts of engaging in dishonest conduct while carrying on a financial services business, contrary to s1041G(1) of the Corporations Act 2001 (Cth). He is not allowed to manage a company until 2028.

Deputy Director of the Commercial, Financial and Corruption practice group, Berdj Tchakerian, said the CDPP works closely with partner agencies, including the Australian Securities Investments Commission, to provide advice and training to investigators about brief preparation in such large-scale cases.

‘The CDPP often provides pre-brief advice to investigators, which can be of immense value during complex and sensitive investigations,’ he said.

‘Such advice may relate to the elements of the offences in question, the sufficiency of evidence to support particular charges prior to a formal brief being submitted, or issues relating to accomplice witnesses. This service is greatly valued by investigative agencies.’

Mr Tchakerian said the CDPP also has extensive legal and related resources that partner agencies can access through the online Partner Agency Portal, which contains a wealth of information designed to assist investigators in many different facets of their work.

Commercial, Financial and Corruption

Deputy Director: Berdj Tchakerian

Matters managed

- Complex tax fraud, often with an international dimension

- Fraud by company directors and employees, other breaches of company directors’ duties

- Corporations Act 2001 offences, including: insider trading, market manipulation, insolvent trading, and publishing false or misleading information about company affairs

- Offences involving financial services or consumer credit, such as operating unregistered managed investment schemes or breaches of relevant licensing requirements

- Bribery of foreign public officials and corruption involving Commonwealth officials

- Serious cartel offences, including price fixing, rigged tenders and restricting outputs

- Money laundering linked to financial crime

top five referring agencies

- Australian Securities and Investments Commission 68%

- Australian Federal Police 14%

- Australian Taxation Office 5%

- Australian Competition and Consumer Commission 4%

- State and territory departments of corrective services 3%

- 126 referrals

- 284 matters on hand

Role

The Commercial, Financial and Corruption (CFC) practice group prosecutes serious financial crimes, focusing on offences involving corporations, financial markets and services, large-scale tax fraud, criminal cartel conduct and bribery and corruption of Commonwealth and foreign officials.

These white collar crimes are typically complex, difficult to detect and challenging to investigate, while prosecutions are often hard-fought by well-resourced defendants.

Trends in 2018–19 prosecutions

CFC is seeing a consistent increase in referrals from the Australian Competition and Consumer Commission (ACCC) relating to criminal cartel offences, which is a relatively new but very important area of work for the CDPP.

Since undertaking Australia’s first prosecution for cartel offences in 2017, CFC has commenced prosecutions in a number of matters. The following cases were currently before the courts as at 30 June 2019:

- an Australian company, its director and a former employee: charged in relation to alleged bid rigging and price fixing in the course of government tenders to supply ‘assistive technology’ products used in hospitals, rehabilitation and aged care facilities

- three banks and six of their senior executives: charged in relation to a series of alleged agreements reached between the parties in the days following an institutional share placement in August 2015

- a union and the Assistant Secretary of one of the union’s branches: charged in relation to an attempt to induce a number of companies to enter into cartel agreements. It is alleged that, in the course of enterprise bargaining negotiations with a number of companies operating in the steel fixing and scaffolding industries, the defendants attempted to induce the companies in each sector to enter into agreements with each other to fix minimum prices for their services

- an Australian company and five individuals: charged in relation to criminal cartel conduct engaged in by money remittance businesses in Sydney and Melbourne, where they agreed to match each other’s exchange rates, constituting a price fixing agreement.

During 2018–19, CFC prosecuted Kawasaki Kisen Kaisha Ltd in the Federal Court. The company pleaded guilty to offences related to market sharing agreements in the international motor vehicle shipping industry and, in August 2019, was convicted and fined $34.5 million.

Foreign bribery cases continue to be a major focus for CFC, with a number of complex prosecutions currently underway. The most significant of these involves the prosecution of a company and six of its employees in relation to the alleged payment of bribes to officials in the Philippines and Vietnam to obtain work on various infrastructure programs.

CFC is also currently prosecuting 14 individuals (Operation Elbrus) in relation to a large-scale tax fraud. The operation relates to an alleged failure to remit Pay as You Go tax instalments to the Australian Taxation Office, involving more than $100 million.

Cases arising from Project Wickenby, a multi-agency operation to combat international tax evasion, continue to be prosecuted by CFC. Although this project formally ended on 30 June 2015, a number of significant cases remain to be finalised.

CFC is an active member of the multi-agency Serious Financial Crime Taskforce, which was established after Project Wickenby ended in 2015. The Taskforce was extended for a further four years from 1 July 2019. It will continue to focus on offshore tax evasion and illegal phoenix activity, as well as expand its activities to deal with transnational and technology-enabled crime.

Law reform

On 23 March 2019, the Australian Government announced the jurisdiction of the Federal Court would be expanded to include corporate crime. The finer details, such as which offences will be covered and the type of committal process are yet to be determined, and remain of great interest to the CDPP. We continue to provide feedback and information on this project.

On 10 April 2019, the Australian Government commissioned the Australian Law Reform Commission to undertake a comprehensive review of the corporate criminal responsibility regime. CFC is providing assistance to the Commission, including meeting with members and responding to requests for information. The Commission’s report will be delivered by 30 April 2020.

Stakeholder engagement

CFC continues to play an active role in providing pre-brief advice to partner agencies, including legal advice during active investigations. We engage with investigators early to provide feedback and guidance about what is required for potential briefs to meet the requirements of the Prosecution Policy of the Commonwealth. Advice covers a diverse range of topics, which might include identifying evidentiary gaps and the steps needed to address them.

We meet our partner agencies on a regular basis at the national and state and territory levels. Our regular collaboration often involves the delivery of training and, increasingly, law reform initiatives. We also provide information sessions on a variety of topics to representatives of our client agencies.

Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry included focusing attention on how regulatory agencies failed to prevent or deter such misconduct from occurring.

The Royal Commission delivered its final report on 1 February 2019 and the Government committed to taking action on all the Commission’s recommendations. The Commission recommended that the Australian Securities and Investments Commission (ASIC) should adopt an approach to enforcement that takes, as its starting point, the question of whether a court should determine the consequences of a contravention.

On 16 November 2018, the Government announced funding for the CDPP over eight years to prosecute cases highlighted by the Royal Commission, and resulting from ASIC’s increased enforcement activity. The CDPP anticipates receiving referrals during 2019–20.

International engagement

Foreign bribery

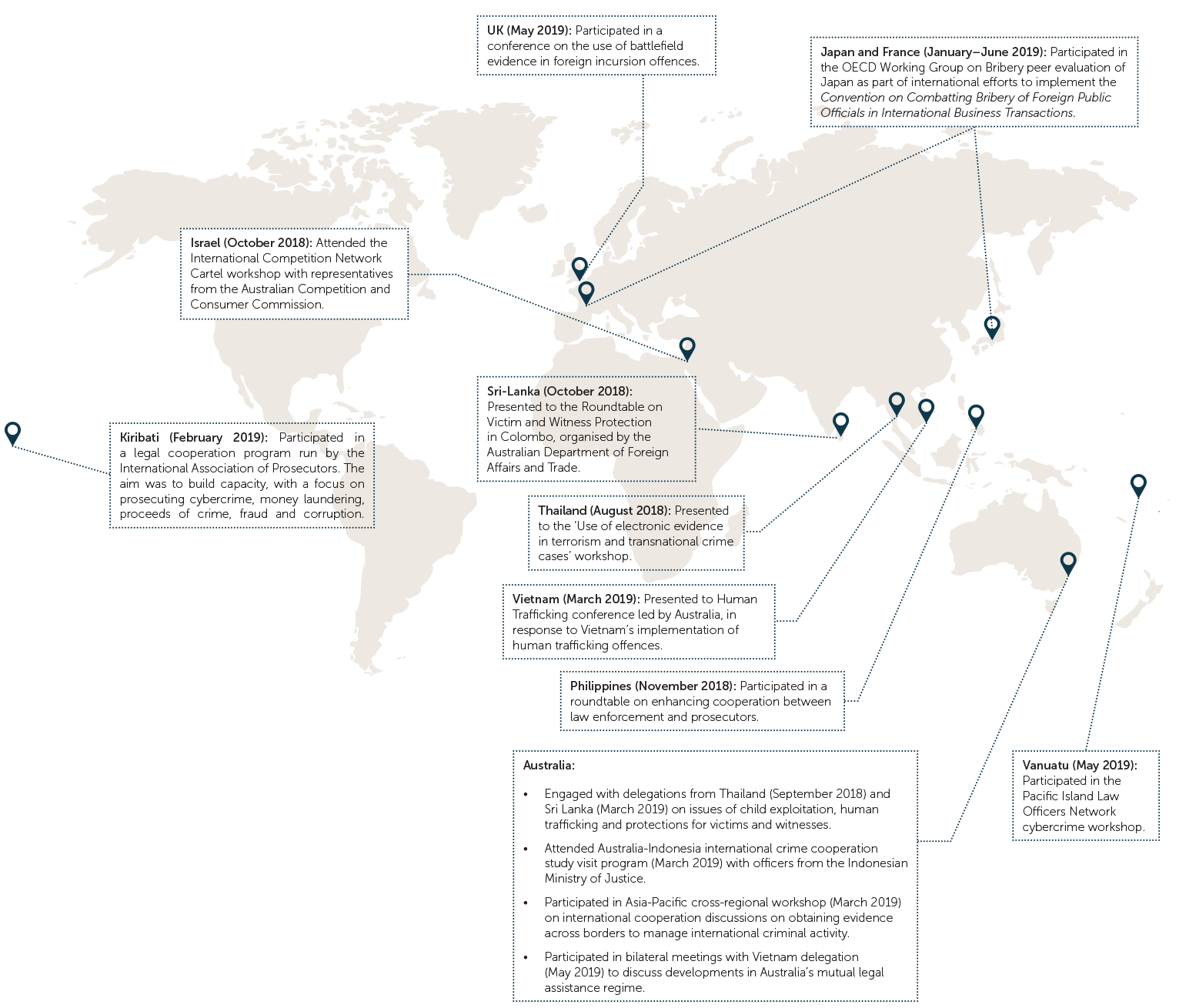

Between January and June 2019, CFC participated in the fourth phase of a peer evaluation of Japan’s implementation of the Convention on Combatting Bribery of Foreign Public Officials in International Business Transactions. We were part of the Australian team assisting the Organisation for Economic Co-operation and Development’s (OECD) Working Group on Bribery.

The Working Group on Bribery comprises representatives from signatories to the Convention, who meet on a regular basis to review international compliance with the Convention. The purpose of the fourth phase review of Japan was to evaluate and make recommendations in relation to its implementation and enforcement of the Convention through its domestic foreign bribery laws. In particular, the review focused on the achievements and continuing challenges since the phase three evaluation in 2011.

Australia and Norway were the appointed peer examiners for Japan. A CDPP lawyer was part of the examination team that conducted an onsite visit in Tokyo between 28 January and 1 February 2019. In June 2019, the examination team attended the OECD in Paris to finalise the draft report, which was adopted by the Working Group on Bribery on 28 June 2019.

Cartels

In October 2018, a CDPP lawyer attended the International Competition Network Cartel Workshop in Israel with representatives of the ACCC. This was a valuable opportunity to discuss a range of issues related to cartel enforcement and prosecutions with international counterparts.

The International Competition Network is an international body devoted exclusively to competition law enforcement. A range of activities and conferences are conducted through this network, including the development of best practices, recommendations and the development of bilateral or multilateral arrangements.

Representatives from more than 60 countries attended the Cartel Workshop. The CDPP was part of a panel discussion on the topic of indictments. The workshop covered all aspects of cartel investigation and enforcement, from intelligence gathering, investigation and enforcement.

Case study Perth insurance broker stole money owed to clients

In April 2019, company director Sergio Amaranti (57) was sentenced to two years and nine months’ imprisonment, with a non-parole period of 18 months, after pleading guilty to seven counts of dishonest conduct.

Between 6 January 2009 and 14 October 2015, Mr Amaranti diverted nearly $200,000 in refunds he owed to clients into personal accounts held in his name. The 51 refunds were owed to 35 clients from Phoenix Insurance Brokers Pty Ltd (Phoenix). The money was to be repaid as a result of cancellations to, and adjustments of, their insurance policies.

Mr Amaranti was employed as a Director of Phoenix from 25 January 2002 to 25 February 2016 and was a senior insurance broker with Phoenix from 2000 to 2015.

In sentencing, Justice Vernon of the District Court of Western Australia emphasised how important it is for company directors to retain the trust of those they deal with.

‘Offending of this type undermines the trust of the community, and customers of Phoenix and the trust that the community has in members of your profession,’ he said. ‘This is a breach of trust of clients, employers, co-directors and co-workers. When this trust is misplaced, this is the most important factor in sentencing.’

As a result of Mr Amaranti’s conviction, he is automatically disqualified from managing companies for five years.

Deputy Director of the Commercial, Financial and Corruption practice group, Berdj Tchakerian, said the case reflects the complexity of this type of prosecution.

‘Many corporate or white collar matters such as Mr Amaranti’s are inherently difficult to prosecute as they involve offending over a long period of time, involve huge amounts of documentary evidence and are complex,’ he said.

To ensure prosecutors working in the CFC practice group are able to analyse and assess evidence effectively and efficiently, they work in teams and use technology where possible to manage the volume of materials associated with financial offences.

Mr Tchakerian said it is also important for prosecutors to ensure they present complex and voluminous matters in a way that makes it easier for a jury to understand.

‘Understanding these issues means that, to date, we have achieved successful outcomes in many large complex financial prosecutions,’ he said.

‘We believe we have an important role as prosecutors in turning our minds to how the allegations might be streamlined and presented to the jury in a comprehensible form, and how trials might be shortened, so that the case appropriately reflects the criminality.’

Case study Paedophile jailed for 40 years for abusing children in Australia and Thailand

In May 2019, an Adelaide paedophile described as ‘a child’s worst nightmare’ by Judge Chapman in the District Court of South Australia, was jailed for 40 years and three months, with a non-parole period of 28 years.

Ruecha Tokputza (31) abused at least 13 children and pleaded guilty to 50 charges, including the persistent sexual abuse of children and possessing tens of thousands of images and videos of child exploitation material.

Mr Tokputza abused children in Adelaide and Thailand, including a 15-month-old, between June 2011 and his arrest in January 2018. He filmed the abuse, often using his mobile phone, and later shared some of the recorded material with others via a messaging app. He also covertly recorded children getting changed while he was at a local swim centre.

An investigation began when South Australia’s Joint Anti Child Exploitation Team (JACET) received a report from Interpol. It included the details of an Internet Protocol (IP) address being used to access an email account, which was associated with the administrator of a child exploitation website on the dark web.

With this information from international law enforcement, JACET was able to identify the IP’s subscriber as Mr Tokputza. On 16 January 2018, the Australian Federal Police (AFP) searched Mr Tokputza’s homes, and in one found several digital storage devices with videos and images of him engaged in sexual activity with a number of children.

Child exploitation matters often involve extensive amounts of digital evidence that is offensive and graphic. In such cases, it is imperative that CDPP prosecutors and police limit the amount of exposure they have to damaging materials, and that evidence is collected in a way that protects authorities and the courts from unnecessary viewing of offensive content.

The CDPP worked closely with JACET to determine how they could ensure fair court proceedings, while handling the evidentiary material in an appropriate way.

As a result, the CDPP’s prosecutor viewed a sample of the material provided by JACET to confirm the elements of the proposed charges could be proved, and to understand the seriousness and nature of the offending in relation to each of the 13 victims.

The next challenge facing the prosecution team was striking the right balance between a series of charges that adequately reflected the gravity and depravity of the offending, while providing the court with the proper sentencing scope to impose an appropriate penalty. To address this, the prosecutor categorised the evidence into groups of offending, then into sets of charges that related to individual victims.

Approaching the evidence in this way helped to limit those involved in the case to unnecessary exposure to child exploitation materials, while ensuring the prosecution’s case accurately reflected the criminal behaviour.

This case highlights the importance of partner agency involvement in prosecutions, to ensure the facts ultimately put before the sentencing Judge accurately capture the extensive criminality involved.

Human Exploitation and Border Protection

Deputy Director: Mark de Crespigny

Matters managed

- Child exploitation

- Trafficking in persons and slavery

- People smuggling

- Passport, visa and other migration fraud

- Telecommunications offences

- Communications offences

- Aircraft and airport offences

- Federal community policing

top five referring agencies

- State and territory police 47%

- Australian Federal PoliceAustralian Federal Police 33%

- State and territory departments of corrective services 11%

- Australian Border Force 8%

- Department of Foreign Affairs and Trade 1%

- 455 referrals

- 583 matters on hand

Role

The Human Exploitation and Border Protection (HEBP) practice group prosecutes a wide variety of offence types including child exploitation offences, trafficking in persons and slavery, people smuggling, passport and migration offences, and offences committed by way of telecommunications services or computers.

A significant proportion of the work involves victims, including child victims. CDPP prosecutors in this area work closely with investigators and the CDPP’s Witness Assistance Service to ensure that, in the course of dealing with this very challenging work, victims are consulted and are treated with courtesy, compassion, cultural sensitivity and respect for their dignity.

Trends in 2018–19 prosecutions

HEBP continues to see a steady increase in victim-based crime. There is a general trend towards child exploitation prosecutions becoming more complex, as investigators target sophisticated offending involving a mix of state and Commonwealth offences. These cases often involve international offending including pay per view offending over the internet and physical contact offending. We are also seeing an increase in the volume of material detected.

These developments have led to a greater emphasis on digital forensics, mutual assistance requests and the amount of time allocated to dealing with vulnerable witnesses, both from an evidential point of view and providing support through our Witness Assistance Service.

Of particular note has been an increase in the number of referrals related to Australian citizens committing sexual offences against significant numbers of child victims overseas. During the reporting period, we prosecuted around 217 people for crimes related to online child sexual abuse, child sex offences outside Australia or other forms of child sexual exploitation both within and outside Australia.

Another significant trend is increased levels of community awareness about crimes such as forced marriage, labour exploitation and human trafficking. There has been an increase in the number of referrals for these challenging matters. In 2018–19, there was a notable conviction in a slavery matter and the first convictions for forced labour charges.

The impact of digital offending

The use of social media by offenders is a disturbing trend, as it enables offenders to mask their identity to target and groom victims regardless of where they live. It is how convicted child sex offender Gareth Hopkins (36) identified new victims and lured them into committing sexual acts for him.

Mr Hopkins created a closed group on a social media platform, encouraging boys aged between 10 and 16 to become members. He followed some 5,000 boys on the platform, and took steps to preserve his anonymity from them and the 98 children in his group. He then began a systematic and planned campaign to groom boys he selected into doing what he wanted.

His interactions with the children lasted several months, escalating from him requesting sexual images in exchange for virtual gifts, to directing one of his victims to live-stream videos while they were performing sexual acts. He encouraged some of his victims to engage in sexual activity with other children and raised the possibility of meeting one of his victims. He also offended online by communicating sexually with other children outside the group and by transmitting sexual descriptions and images of children to other adults.

While police were able to identify two Australian-based victims, the nature of this crime type means it can be hard to know how many victims are affected or where they come from. This can make it challenging to provide support to victims.

In this case, Mr Hopkins engaged in the criminal activity while he was on parole for other sexual offences against children. He pleaded guilty to the charges laid against him, and will not be eligible for parole until 2028.

The good news… conviction rates for people charged with child sex offences are high. During 2018–19, all of those prosecuted to finality by the CDPP for this crime type were convicted. 61 per cent received an immediate custodial sentence, and a further 24 per cent received a suspended custodial sentence.

Prosecution services

Providing pre-brief advice to investigative agencies continues to be a significant aspect of HEBP’s prosecution service. Early and timely advice is beneficial to both the CDPP and investigative agencies.The provision of our pre-brief advice assisted in the successful prosecution of two juveniles for significant cybercrime offences, which were finalised in 2019.

Liaising with our partner agencies about emerging issues also enables us to focus our resources effectively.

HEBP organised the 2018 AFP/CDPP Child Abuse Investigations and Prosecutions Workshop, and continues to be involved in developing solutions to how we can best manage increased volumes of child abuse material and data, the need for victim identification, and the risks posed to those working in this area.

Law reform

Our practice group continues to work closely with the Attorney-General’s Department and the Department of Home Affairs regarding new legislation and the operation of existing laws.

During 2018–19, significant law reform work was undertaken in the areas of child sexual exploitation, forced marriage, vulnerable witness protections, non-consensual sharing of intimate images of adults, and the transmission of abhorrent material online.

In the child exploitation area, HEBP provided input on draft Bills regarding: the grooming of third parties to assist in the sexual exploitation of children; aggravated offences; a Commonwealth offence for possessing child abuse material; responses to the Royal Commission on Institutional Responses to Child Sexual Abuse; and important changes to wording within legislation to reflect that all child pornography material offences involve the abuse of children.

Reform also continues in the human trafficking area, and HEBP has contributed to the discussion on Bills relating to the forced marriage of persons under the age of 16, as well as the relevant evidence and additional protections needed for vulnerable witnesses.

Stakeholder engagement

HEBP continues to have close liaison relationships with the Australian Federal Police (AFP) and Australian Border Force (ABF). The practice group meets regularly with investigators in regional offices, and meets quarterly at a national level.

We receive a high number of referrals from the state and territory police forces, particularly in relation to child exploitation offending. HEBP has a high level of interaction with police who specialise in child exploitation matters. In many jurisdictions the CDPP meets regularly with the Joint Anti-Child Exploitation Team (JACET), a joint initiative between the AFP and state and territory police forces.

In June 2018, HEBP launched a guide to preparing briefs of evidence in straightforward child exploitation matters. The guide is designed to support police in handling these matters efficiently and effectively, so they can focus more of their resources on investigating and managing more complex matters.

HEBP contributes to the Australian Government’s National Action Plan to Combat Human Trafficking and Slavery by providing domestic and international training and engagement, and through membership of the Operational Working Group and the Labour Exploitation Working Group.

The HEBP practice group has a Human Trafficking and Slavery focus group, and also a Cybercrime Focus Group, that bring together prosecutors particularly interested in these prosecutions, and provides a point of contact for liaison in relation to these types of offending.

International engagement

The HEBP practice group participated ininternational engagement in 2018–19, including:

- Sri Lanka 18–19 October 2018: A prosecutor delivered two presentations at the Roundtable on Victim and Witness Protection in Colombo. The first addressed victim and witness participation in the Australian criminal justice process. The second focused on the use of vulnerable witness protections in a human trafficking case study. The Roundtable was organised by the Australian Government Department of Home Affairs and attended by representatives from

Sri Lanka’s Ministry of Justice, Attorney-General’s department, police, National Authority for the Protection of Victims of Crime and non-government organisations supporting and protecting human trafficking victims. - Vietnam 24–29 March 2019: A prosecutor gave presentations at two human trafficking conferences in Ho Chi Minh City and Da Nang about the Australian criminal trial process, evidence, and case studies of Australian human trafficking prosecutions. The conference was attended by members of the judiciary, police and prosecuting bodies in Vietnam. It was supported by the Australian Government following the implementation of human trafficking offences in Vietnam.

Visiting delegations

- Thailand 19 September 2018: At the request of the AFP, prosecutors in Melbourne participated in discussions with a visiting Thai delegation about child exploitation and human trafficking prosecutions.

- Sri Lanka 28 March 2019: Officials from the Sri Lankan National Authority for the Protection of Victims of Crime and Witnesses met with our prosecutors and a Witness Assistance Officer in Melbourne for further information on CDPP practices.

Case study Couple jailed for keeping woman as a servant

In April 2019, a Brisbane couple was sent to jail, the first people in Australia’s history to be convicted on forced labour charges. In sentencing, the judged described their behaviour towards a Fijian woman who had worked as their domestic servant for eight years as calculated and criminal.

The jury also found Malavine Pulini (48) guilty of human trafficking after she deceived the victim and confiscated her passport shortly after the victim arrived in Australia.

The victim, who cannot be named, worked six days a week from 6am to 10pm as a nanny and domestic servant, and was paid on average $200 per fortnight. She was unable to see a doctor or dentist despite having chronic health conditions. She was allowed only limited contact with her family in Fiji and was unable to visit them. Although she had a key to the house and was allowed to attend church, the couple restricted her social contact.

The victim only came to understand that she had a way out when a friend passed her information from a television program. She secretly packed her things and ran away, and was later assisted by the Salvation Army and the AFP.

In sentencing the couple, Judge Clare SC said, ‘We live in an age of international mobility, where people can bring others from lower socioeconomic communities into the country to exploit them. There ought to be a clear message that this will not be tolerated.’

Judge Clare said the conditions and the poor manner in which the victim was treated caused her to feel voiceless, broken and hopeless. She said that the eight years had taken a terrible toll on the victim.

Ms Pulini was sentenced to six years’ imprisonment for forced labour, five years’ imprisonment for human trafficking and five years’ imprisonment for harbouring an unlawful non-citizen. All sentences are to be served concurrently.

Isikeli Pulini (57) was sentenced to five years’ imprisonment for forced labour and five years’ imprisonment for harbouring an unlawful non-citizen. All sentences are to be served concurrently.

A non-parole period of two years’ imprisonment was set for both offenders.

Both offenders have appealed against their convictions and sentence. The Queensland Court of Appeal has reserved its decision following the hearing of the appeal on 25 July 2019.

Victims and witnesses

In February 2019, the Commonwealth Attorney-General launched the CDPP’s new online resource for victims and witnesses. We developed materials for the site in response to recommendations from the Royal Commission into Institutional Responses to Child Sexual Abuse.

The site was developed after extensive research including speaking to victims and witnesses. It provides essential information to victims, their caregivers and witnesses about the prosecution process in easily understood language, and includes video presentations. The site is available in more than 100 languages.

Victims of Crime Policy

The CDPP believes that in all prosecutions, victims of crime should be treated with courtesy, compassion, cultural sensitivity and respect for their dignity and entitlements.

The CDPP Victims of Crime Policy sets out our obligations towards victims, including our responsibility to keep them informed of the progress of their case and to consult with them where appropriate.

In addition to establishing effective processes and procedures linked to the Prosecution Policy of the Commonwealth and the work of our lawyers in interacting with victims, we have a dedicated and valued Witness Assistance Service to support the most vulnerable victims and witnesses involved in the matters we prosecute.

Witness Assistance Service

We celebrated the tenth anniversary of our Witness Assistance Service (WAS) in November 2018.

The WAS is a national service with dedicated staff who have social work backgrounds. Team members are located in our Sydney and Melbourne offices, and in 2018–19 there were 3.8 full-time equivalent positions. In response to the increasing number of Commonwealth prosecutions involving victims of crime and our associated policy obligations, four new positions, including an Assistant Manager role, have been created.

Our WAS staff provide a range of information and support services, including updates on the progress of a prosecution, general information about the prosecution process, court tours, referrals to support services, support at court and during conferences with legal staff, and information concerning victim impact statements.

The WAS delivers these services in accordance with the Prosecution Policy of the Commonwealth and Victims of Crime Policy.

Referrals to the service

The WAS Referral Guidelines require that all identifiable child victims and victims of slavery, servitude and forced marriage offences be referred to the WAS by prosecutors. Such matters, known as ‘Category A’ matters, must be referred within 21 days of their arrival. During 2018–19, the guidelines were reviewed, and ‘Category A’ matters were expanded to include any direct family member of a person who has died as a result of any alleged offence, or any victim suffering serious physical or psychological harm as a result of alleged offences.

In 2018–19, the WAS received and accepted 376 new victim/witness referrals, relating to 91 new prosecution matters and four previously referred matters. A total of 174 (46 per cent) of all new victims/witnesses referred were children. There were 4,427 instances of contact with victims/witnesses referred to the service.

Training and education